2015/12/16 Commentary: Fed’s ‘Normalcy Bias’ Continues (late)

© 2015 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY (Non-Video): Wednesday, December 16, 2015 (late)

Commentary: Fed’s ‘Normalcy Bias’ Continues

We have already explored this topic at some length in our Will 2016 be 2007 Redux? (‘Redux’) post (back on Tuesday the 8th.) There are many other reasons why headwinds will be strong enough to present significant challenges to the global economy and equities in 2016. And in spite of Fed Chair Yellen’s assurances that inflation would rise on the back of a strengthening US economy, the Fed raising rates beyond Wednesday’s ‘liftoff’ from the longstanding ZIRP (Zero Interest Rate Policy beloved of Ben Bernanke) is problematic at best.

We have already explored this topic at some length in our Will 2016 be 2007 Redux? (‘Redux’) post (back on Tuesday the 8th.) There are many other reasons why headwinds will be strong enough to present significant challenges to the global economy and equities in 2016. And in spite of Fed Chair Yellen’s assurances that inflation would rise on the back of a strengthening US economy, the Fed raising rates beyond Wednesday’s ‘liftoff’ from the longstanding ZIRP (Zero Interest Rate Policy beloved of Ben Bernanke) is problematic at best.

And much of the problem with the seemingly still ‘gradualist’ rate increase view is that it doesn’t make sense. Not from the Fed’s projections, or in some ways even from the FOMC statement (in our lightly highlighted version.)

In the very minor first instance the 25 basis point hike will raise short term credit card interest rates to the consumer. And the banks have already made clear that in a global savings glut (see Redux on that), there is no incentive to raise deposit rates. This is small potatoes to be sure. Yet it indicates how even though this single move does not impair the outlook, the extended implications are not good.

As also covered at some length in ‘Redux’, The Fed is trying desperately to restore a sense of ‘normalcy’. It hopes the public and markets agree. However, as noted previous, if getting back to ‘normal’ means the ‘new normal’ it is less than propitious. That could be an environment not capable of sustaining higher levels of consumer activity in the home of conspicuous consumption. And that is six years into the ‘recovery.’ If things fizzle now, it does not bode well for the global economy.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options and join us. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

2015/12/16 TrendView VIDEO: Concise Highlights (early)

2015/12/16 TrendView VIDEO: Concise Highlights (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Wednesday, December 16, 2015 (early)

As noted on Tuesday, last week was ‘Oil Spoiler meets Fed Dread’. Yep, just like one of those Grade B science fiction thrillers, on the order of ‘Godzilla Meets Gorgo’. While the damage to equities last week spilling over into Monday was nothing like the carnage visited on Tokyo and London in those epics, it was as dynamic as any of the recent sharp selloffs.

Worries about oil patch values dropping and spillover from negative announcements from commodity producers spooked the equities. See Tuesday’s Global View post for our analysis of how that also spilled over into Monday morning in spite of some fairly good economic data of late. And one of the compounding factors was the concern over the FOMC likely hiking rates this week in spite of all that oil and commodity weakness.

Yet, Crude Oil continued to stabilize (actually rallying very nicely) out of Monday into Tuesday morning. NYMEX January Crude Oil future was up from a test of the major 35.00 support we anticipated would be hit to the mid-37.00 area. And that was the sign it was time for ‘Santa Portfolio Manager’ to come out of hiding. While that might be deterred by the market response to whatever FOMC does this afternoon, it is increasingly apparent and what Janet Yellen has to say about it after the initial statement and projections will not be particularly hawkish. There will likely be enough dissenters on the FOMC to leave the very consensual Chair alluding to a heavy data dependent focus for future moves.

While not necessarily a clear ‘one and done’, we find it hard to believe it will be hawkish. (See much more on that in last Tuesday evening’s Will 2016 be 2007 Redux?) And if she sounds circumspect, the equities should continue to celebrate and govvies weaken.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the return to stronger US data from last Friday’s PPI and Retail Sales right into Tuesday’s CPI and this morning’s Housing Starts and Permits. That was preceded this week by above-estimate German and Euro-zone ZEW Surveys. And on recent form even Japanese economic data has been improving. While we expect the US data to weaken into next year, all of this is the backdrop for the seasonal rally continuing if Crude Oil remains stabilized.

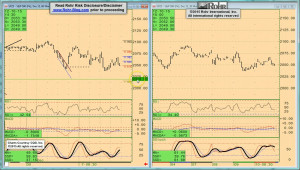

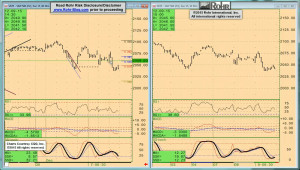

It moves on to S&P 500 FUTURE short-term view at 02:30 and intermediate term at 06:45, with only mention of OTHER EQUITIES from 09:30 and GOVVIES from 10:30 including the BUND at 12:45, and only mention of SHORT MONEY FORWARDS from 13:45. Foreign exchange is also only mentioned, with US DOLLAR INDEX at 14:15, Europe at 15:00, ASIA at 16:15 and CROSS RATES mostly steady with the euro keeping the bid against the other currencies at 17:45 prior to returning to the S&P 500 FUTURE short term view at 18:15.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...