2016/10/13 Commentary: Fear of Fed… with a twist

© 2016 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY: Thursday, October 13, 2016

Fear of Fed… with a twist

There was not really any mystery in the equities anticipation and subsequent negative reaction to Wednesday afternoon’s FOMC meeting minutes. Some might feel that the degree of weakness spilling over into Thursday morning was overblown. Yet very typical compounding factors from the Fed’s extended ‘normalcy bias’ are in play once again. It would be comical if it were not tragic that the alleged leading developed world central bank is incrementally diminishing its credibility. That has not just been the case of late. This goes all the way back to and especially after last December’s first minor base rate increase in almost a decade. (For more click into the Fed has No Cred! link near top sidebar; and that was from back in March.)

There was not really any mystery in the equities anticipation and subsequent negative reaction to Wednesday afternoon’s FOMC meeting minutes. Some might feel that the degree of weakness spilling over into Thursday morning was overblown. Yet very typical compounding factors from the Fed’s extended ‘normalcy bias’ are in play once again. It would be comical if it were not tragic that the alleged leading developed world central bank is incrementally diminishing its credibility. That has not just been the case of late. This goes all the way back to and especially after last December’s first minor base rate increase in almost a decade. (For more click into the Fed has No Cred! link near top sidebar; and that was from back in March.)

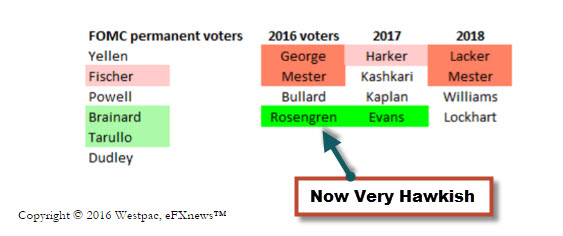

And there is a very interesting twist regarding the next in the series of ‘done deal’ rate hikes that have not happened so far in 2016, where the Fed predicted four last December. That ‘twist’ is the changes to the FOMC voting members in 2017, effective at the first meeting. The question becomes the incentives to raise rates at the last meeting of the current much more hawkish FOMC, or decide that conditions are still inhospitable for anything that might weaken an already less than strong US economic growth.

In that regard the Fed seemingly remains ‘data dependent’, which is one of the key reasons it was destructive folly to put forth such aggressive US growth and interest rate projections along with last December’s rate hike (see our December 16th post.) This was a clear example of enlisting an aggressively bullish future view to justify what they did.

And it is much the same at present. Yet even the current minutes and changes in the economic data since the FOMC meeting are once again belying the Fed’s ‘rose-tinted’ economic view. While there is much more on that below, first consider that FOMC voting dynamic. December will be the last meeting of the currently most hawkish FOMC voting members prior to a dovish shift into January 2017 for the balance of the year.

How this will play out makes all of the near term economic data even more important. Will the outgoing voting members be interested in a smooth transition into what will clearly be a more dovish FOMC? OR… do they adopt a Nike strategy and “Just do it”? This is critical on other levels as well, especially the current likely result of the US general election.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

2016/10/18 Quick Update: Feeble Figures… again

2016/10/18 Quick Update: Feeble Figures… again

© 2016 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Quick Update: Tuesday, October 18, 2016

Feeble Figures… again

The question becomes the incentives to raise rates at the last meeting of the current much more hawkish FOMC, or decide that conditions are still inhospitable for anything that might weaken an already less than strong US economic growth.

As in all of the previous circumstances in that regard since the first rate hike in almost a decade last December, the Fed seemingly remains ‘data dependent’. That is one of the key reasons it was destructive folly to put forth such aggressive US growth and interest rate projections along with last December’s rate hike (see our December 16th post.) This was a clear example of enlisting an aggressively bullish future view to justify what they did.

Much the same seems to have occurred since the Jackson Hole ‘Hawk-fest’ in the wake of a string of temporarily stronger US economic releases. As also noted last Thursday, how this will play out makes all of the near term economic data even more important. Will the outgoing voting members be interested in a smooth transition into what will clearly be a more dovish FOMC if the data weakens? OR… do they defy the data and adopt a Nike strategy of “Just do it”?

It has been typical after previous intensification of the hawkish view at the FOMC for the data to weaken, as it did late last week into this week. Yet in spite of very much weaker than expected Empire Manufacturing and slightly light US Industrial Production Monday and US CPI today, the equities have not weakened down to the lower, more attractive support levels. Instead of that the late September 2015 psychology where weak data turned into a ‘bad news is good news’ (no FOMC hike) psychology has already arrived.

The more important Fed influence returns with Wednesday afternoon’s Fed Beige Book release, followed by more extensive economic data on Thursday prior to a quiet Friday. The dilemma is that the US equities have already rallied back up near the key higher resistance, and whether they can sustain activity above it will likely determine the next near-term swing.

That’s it for now on this Quick Update. Please refer to the last Thursday evening’s Commentary: Fear of Fed…with a twist post for a more extensive review of the psychology, and the Friday evening Market Observations update in the lower section of that post for the still relevant Evolutionary Trend View for price movement perspective.

Thanks for your interest.