2017/09/21 Commentary: Fear of Fed Redux

© 2017 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Commentary: Thursday, September 21, 2017

Fear of Fed Redux

As we had suspected in our Wednesday morning Commentary: Fear of Fed post, ‘Fed dread’ is back. That was just an extension of the somewhat stronger economic data releases in spite of weaker important US data last Friday. Yet, ever since Hurricane Irma was a bit less devastating to Florida than had been feared, the US equities were keeping the bid and govvies were under pressure since the beginning of last week. Especially in the context of higher than expected UK inflation numbers initially followed by others, the govvies finally had to be more concerned about that than responsive to the near term economic weakness engendered by the US dual storm damage.

As we had suspected in our Wednesday morning Commentary: Fear of Fed post, ‘Fed dread’ is back. That was just an extension of the somewhat stronger economic data releases in spite of weaker important US data last Friday. Yet, ever since Hurricane Irma was a bit less devastating to Florida than had been feared, the US equities were keeping the bid and govvies were under pressure since the beginning of last week. Especially in the context of higher than expected UK inflation numbers initially followed by others, the govvies finally had to be more concerned about that than responsive to the near term economic weakness engendered by the US dual storm damage.

Of course, this took on extra importance in the context of the upcoming FOMC meeting that culminated in Wednesday afternoon’s statement and projections revisions, followed shortly thereafter by Chair Yellen’s press conference. And we have followed our classical protocol that the knee-jerk reaction to the FOMC impact is less important than the 24-48 hour trend evolution the markets need to reflect their full response. That has been very telling in the US dollar as well, and especially the govvies that have swung down into their most critical position since early July.

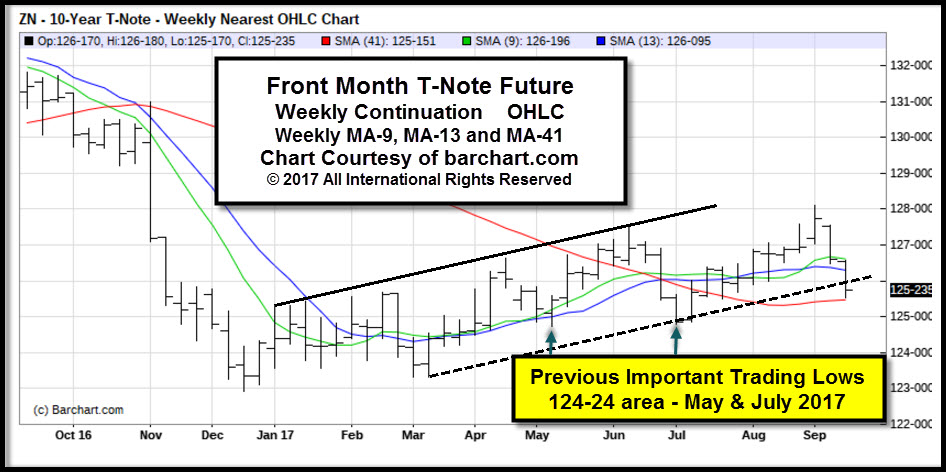

That is the reason we opened with a weekly front month T-note future continuation chart illustrating the consideration of whether the December T-note future will respect overall up channel support from the 122-29 mid-December post-US election trading low. While it has penetrated that up channel support to some degree, as always with these sorts of things it is more important whether it exhibits a sustained violation of that trend support than whether it drops temporarily below it. And after laying out all of the background on whether the Fed’s shift into reducing its balance sheet will be a telling influence in our previous post, this post will be more market trend oriented after some brief further review of just what the Fed will be doing.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

2017/09/28 Commentary: Trump Tax Tract

2017/09/28 Commentary: Trump Tax Tract

© 2017 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Commentary: Thursday, September 28, 2017

Trump Tax Tract

While we cannot argue with a proposition that has proven true again and again from the Kennedy era onward, this particular tax reform proposal has some internal contradictions along with political hurdles that are greater than previous efforts. So there are pros and cons where the cons are either especially troubling or outright ploys. While we will get back to a more extensive discussion below, it is important to note the most contentious of the ‘streamlining’ proposals that also raises quite a bit of the revenue to fund the overall tax cuts is the elimination of state and local income tax deductions.

On one hand, this is a rational adjustment. On a politically conservative philosophical level as well as a practical consideration, why should the rest of the country underwrite the revenue collected by those local governments? It is a direct cost to the rest of the country in the form of the greater revenues collected from other states. And yet….

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

Read more...