2017/10/31 Commentary: Bank-O-Rama

© 2017 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Commentary: Tuesday, October 31, 2017

Central Bank-O-Rama

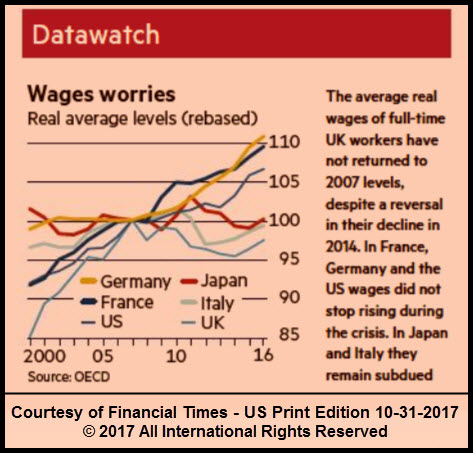

Haven’t used that one since the early 2015 accommodation-fest. Very different now with central banks having such rightful divergent agendas depending on their various country economic performance, inflation tendencies and where they are in their monetary stimulus programs along with political considerations. Yet first, consider the opening graph (we love when the FT publishes research from a credible source just as we are trying to make a related point.) Along with the research resources we have introduced to debunk outdated Phillips Curve notions (see the end of our July 20th post for Gavyn Davies’ views for one), there is the simple lack of wage growth despite sometimes impressive employment gains. And because the US has led developed economies out of post 2008-2009 Crisis weakness with the most proactive central bank, just consider the rebased wage change there since 2000.

Haven’t used that one since the early 2015 accommodation-fest. Very different now with central banks having such rightful divergent agendas depending on their various country economic performance, inflation tendencies and where they are in their monetary stimulus programs along with political considerations. Yet first, consider the opening graph (we love when the FT publishes research from a credible source just as we are trying to make a related point.) Along with the research resources we have introduced to debunk outdated Phillips Curve notions (see the end of our July 20th post for Gavyn Davies’ views for one), there is the simple lack of wage growth despite sometimes impressive employment gains. And because the US has led developed economies out of post 2008-2009 Crisis weakness with the most proactive central bank, just consider the rebased wage change there since 2000.

From as low a base back in 2000 only France has done better. Based on other economic indications we assume this is more so a reflection of the power of French labor unions than any economic outperformance. Yet US cumulative wage growth of 16% (from 92 to 107) is not that impressive. With mediocre inferred 1.0% wage growth over that 16-year horizon, why is anyone surprised inflation is not higher? Or that the central banks are frustrated in their ‘normalcy bias’ that it should be?

After that quick revisit to matters previously reviewed, it is more important to focus on what’s coming up in the central bank sphere and areas closely related enough to make a difference. While we will expand below, after last week’s very clever ECB accommodation extension the remainder of this week sees the FOMC (statement only) Wednesday, BoE Inflation Report and press conference Thursday after Wednesday’s ‘reveal’ (like a magic trick) of the House’s full draft of the US tax reform bill, and even President Trump’s choice for the next Fed Chairman. In the spirit of the day: Boo!!

Authorized Subscribers click ‘Read more…’ (below) to access balance of the discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review options. As this is a ‘macro’ assessment, Market Observations remain the same as last Thursday’s Commentary: Leap of Faith post that were updated (lower section) after Friday’s Close, and there is no Extended Trend Assessment in this post.

2017/10/11 Commentary: Trump Tax Tract II

2017/10/11 Commentary: Trump Tax Tract II

© 2017 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Commentary: Wednesday, October 11, 2017

Trump Tax Tract II

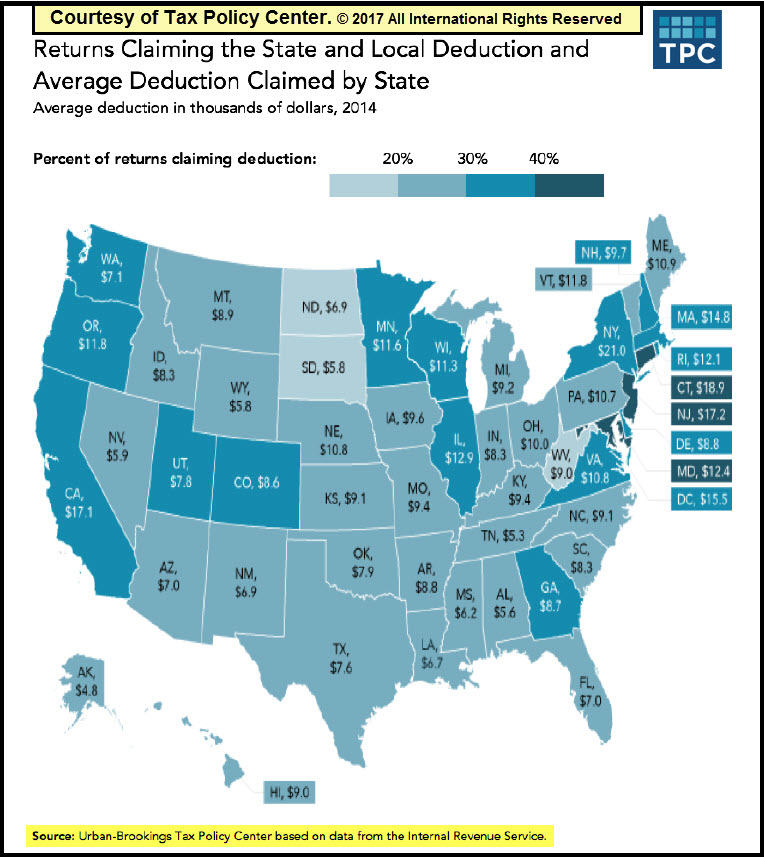

However, that does not compare to anything bigger that can be signed into law, and have more durability than even Mr. Obama’s far reaching executive actions. So it is now onto tax reform as a last best hope for Republicans to ‘accomplish something’ prior to the end of the year. Yet not only was the health insurance reform fiasco a failure in its own right, as we have outlined previous it is also a drag on the tax reform effort due to the continued Obamacare spending. Along with other inconsistencies in current tax reform proposals (much more on that in the original Trump Tax Tract post and below), there are now the same sanguine assurances coming from Mr. Brady and others that the Republican leadership is working on a tax plan that will appeal to all and which they can pass into law before year’s end. Yet details are lacking. Don’t take our word for it. Just listen to his assurances delivered last week to CNBC’s Becky Quick.

For one thing those allege this is significantly a ‘middle class tax cut’, which has been refuted by most independent analysts. There is also the very tight deadline that Quick notes: as of this morning there are 30 dual House and Senate legislative days before the holiday recess begins December 14th, with a few extra sessions for each. Very aggressive to think they can get this done, and what is not in the video is his repeated refusal to provide details; a lot like the healthcare effort. Then there are the contradictions…

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

Read more...