2015/09/30 TrendView VIDEO: Concise Highlights (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Wednesday, September 30, 2015 (early)

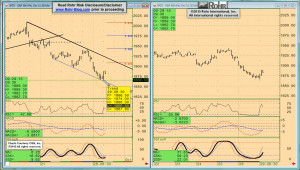

Consumer Confidence to the rescue. That was both in the US Tuesday and China this morning. While other data had improved of late, the US figure yesterday seemed to rescue the December S&P 500 future from a key lower support, even if the bears spent most of Tuesday attempting to pressure it back down to and even a bit below that key 1,866 level. However, rebounding late in the session left a 1,874.50 Close for the day. While nothing is guaranteed when a bear trend rebounds modestly from a test of interim support, the sheer volume of end of month data that was going to impact the markets this morning created a sense of comfort. Unless the data was going to be bad enough to create a gap lower below Tuesday’s 1,862 trading low, it was more likely that the equities were going to rebound to some degree.

The additional influence from very early in the global trading session (in fact 20:45 CDT Tuesday evening) of stronger than expected Westpac-MNI Chinese Consumer Sentiment (118.2 versus 116.50 last month) was enough to encourage the extensive bid that saw the December S&P 500 future test the top end of failed 1,900-1,895 support (i.e. resistance now ) in overnight electronic trade. Yet the cautionary word here is even as important as that range may be, short term trend resistance is up into the 1,908-10 range early today, only dropping to the 1,900 area late session into Thursday morning. And we have begun this analysis with an atypical jump into the technical trend review because the decision by the equities is also important to the overall trend psychology of other markets right now.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the weaker data from two weeks ago becoming a bit stronger again. With the notable exception of Monday’s Chinese Industrial Profits, other items have all been stronger; especially US Consumer Confidence. Yet today’s major end-of-month data was mixed, with the notable exception of that significantly better than expected Chinese Consumer Sentiment figure. However, markets will still need to deal with Thursday’s global Manufacturing PMI’s leading into Friday US Employment report. Along the way there will be a major flow of central bank-speak, especially from Fed conferences from Thursday into Friday.

It moves on to the S&P 500 FUTURE short-term view at 03:00 and intermediate term at 05:15 with only mention of OTHER EQUITIES from 07:45 and GOVVIES from 09:00 (with BUND comments at 09:45) and SHORT MONEY from 10:15. Foreign exchange is also only mentioned, with US DOLLAR INDEX at 10:45, Europe at 11:00, ASIA at 11:45 and CROSS RATES showing a bit of euro weakness at 12:00 prior to returning to the S&P 500 FUTURE short term view at 13:00 for a final look.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

2015/10/01 TrendView VIDEO: Concise Highlights (early)

2015/10/01 TrendView VIDEO: Concise Highlights (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Thursday, October 1, 2015 (early)

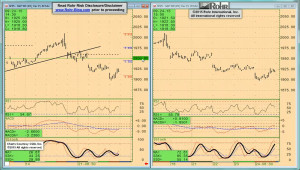

Consumer Confidence to the rescue, and then some. In hindsight the US Tuesday number and Wednesday China reading provided the equities with even more upside momentum after Monday-Tuesday pressure than we had previously expected. While other data had improved of late, those two figures not only rescued the December S&P 500 future from key lower 1,866 support; they even encouraged a push back above the 1,895-1,900 area. And for various reasons reviewed in today’s video analysis as well, that is an even more important technical threshold than previously noted. It is now also the Tolerance of the short term down channel 1,903 UP Break (see chart above.)

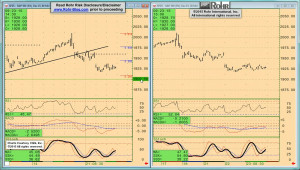

Which is why we specified in our earlier note it would be useful to wait until after the US ISM Manufacturing Survey to assess further trend activity. Along with much higher than expected Challenger Job Cuts this morning, the weak ISM figure has brought December S&P 500 future back down into that critical range this morning. There is much else that is discussed in the video on the major ‘macro’ influences this morning.

We still see the overall ‘macro’ background as negative for equities and conversely constructive for govvies, which never weakened in the face of the extensive overnight electronic trading bid in the December S&P 500 future. Yet, we are content to allow the market to indicate its trend preference over the near-term into tomorrow's US Employment report. And we have commenced our analysis with market views once again today in consideration of the very critical nature of the current trend decisions in all asset classes.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the weaker data from two weeks ago becoming stronger again; especially recent US and Chinese Consumer Confidence. Yet today’s major top-of-the-month data was mixed, with the Chinese Manufacturing PMI still weak along with the US figures noted above. However, markets will still need to deal with Friday’s US Employment report. Along the way there will be major central bank-speak, especially from Fed conferences today into tomorrow.

It moves on to S&P 500 FUTURE short-term view at 03:15 and intermediate term at 05:15 with only mention of OTHER EQUITIES from 08:30 and GOVVIES from 09:45, yet with full review of the BUND at 10:30, reverting back to mention of SHORT MONEY FORWARDS from 13:30. Foreign exchange is also only mentioned, with US DOLLAR INDEX at 14:00, Europe at 14:15, ASIA at 14:45 and CROSS RATES showing a bit of euro weakness at 15:30 prior to returning to the S&P 500 FUTURE short term view at 16:00.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...