2015/12/08 Commentary: Will 2016 be 2007 Redux? (late)

© 2015 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY (Non-Video): Tuesday, December 8, 2015

Commentary: Will 2016 be 2007 Redux?

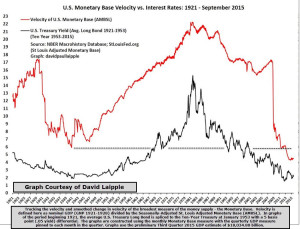

They say that the market never repeats exactly, but it rhymes. While we cannot see any reason 2016 will be the start of anything quite so bad as what transpired out of 2007 into 2008, there are good reasons to be skeptical of the equities. That goes along with it likely being another year that frustrates the Bond Cassandras. The latter is not much of a speculation, as the bond skeptics have been wrong from the time the US economic recovery began back in 2010. Yet the equities have defied multiple stumbling blocks to climb the proverbial wall of worry for the past six years.

They say that the market never repeats exactly, but it rhymes. While we cannot see any reason 2016 will be the start of anything quite so bad as what transpired out of 2007 into 2008, there are good reasons to be skeptical of the equities. That goes along with it likely being another year that frustrates the Bond Cassandras. The latter is not much of a speculation, as the bond skeptics have been wrong from the time the US economic recovery began back in 2010. Yet the equities have defied multiple stumbling blocks to climb the proverbial wall of worry for the past six years.

That included shaking off the rather scary reactions in 2011 (including the US debt default and euro crisis) and again late last year (Ebola epidemic) into last summer (Chinese weakness and currency adjustments.) Yet here sits the S&P 500 within 3.0%(+/-) of its May all-time high. So while we are indeed negative on the equities (and friendly the primary government bond markets) into next year, there remain good reasons to respect the bull until after the first part of January. After that the range of factors we review below will most likely make for more challenging US and global economies and equity markets.

Yet for right now there is a Santa versus Satan scenario playing out. And the timing of each influence reinforces the suspicion that the bulls still have some time prior to the darker aspects holding sway over the markets. There have been very good recent examples of how any downside volatility can be contained in the near term.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options and join us. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the extended trend assessment as well.

2015/12/09 TrendView VIDEO: Concise Highlights (early)

2015/12/09 TrendView VIDEO: Concise Highlights (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Wednesday, December 9, 2015 (early)

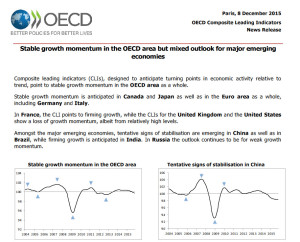

Our Friday pre-US Employment Early Alert began with the headline “Draghi Disappointment & General Rout.” However, shortly after that on Friday morning Mario Draghi ‘embellished’ his contained comments on maintaining the same level of monthly securities purchases under ECB’s Quantitative Easing program. He returned to oft stated market and economy support that the ECB was prepared to do whatever is necessary to restore Euro-zone growth and inflation over the intermediate term. While that restored confidence in the near term, the weakness of the energy and commodity markets this week are weighing on the equities once again and boosting the govvies. And the response in the foreign exchange is differentiated by whether a particular economy is a commodity producer or consumer. Ergo the weakness in the Australian dollar while the euro has bounced back again.

Yet there is a sense that equities will likely be alright once the spillover from the energy and commodity markets abates. After all, lower priced energy in particular is good for developed economies. The problem now is the major components of the equity indices comprised of energy and commodity producing companies. Once the energy markets complete their current fall to new lows for the current down trend, the equities are likely to rebound (more on that below.) And there is also that consistent friendly seasonal factor…

The Santa Claus (more like ‘Santa Portfolio Manager’) rally influence. Even the sharp drop into the horrific Paris terror attacks, saw an immediate rebound. And it is important to note this still means a tendency toward willing buyers on selloffs. For more on ‘Santa Portfolio Manager’ that we remind folks is actually the case every year (at least in the firm-strong ones) see last November’s post on that.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the return to weaker data in the US last week prior to Friday’s firm US Employment report. Weakness of Chinese data continues this week in depressed trade volumes accompanied by the same in Germany along with weak German Industrial Production. US NFIB Small Business Confidence was also weak into US Wholesale Sales today and Retail Sales on Friday.

It moves on to S&P 500 FUTURE short-term view at 04:00 and no intermediate term view that is the same as Monday, with only mention of OTHER EQUITIES from 06:00 and GOVVIES from 07:15 including video of the BUND at 08:30, and only mention of SHORT MONEY FORWARDS from 11:45. Foreign exchange is also only mentioned, with US DOLLAR INDEX at 12:15, Europe at 12:45, ASIA at 14:00 and CROSS RATES that are mostly steady yet with a weak Australian dollar and strong euro at 15:45 prior to returning to the S&P 500 FUTURE short term view at 17:00.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...