2016/02/23 TrendView VIDEO: Global View (early)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Tuesday, February 23, 2016 (early)

As we have noted of late for equities, this seems like an ‘abysmal news is good news’ phase. There is little doubt that outside of a few select bright spots (mostly in the US), overall economic data has been abysmal. That continued into the top of this week on weaker Chinese MNI February Business Indicator dropping back below 50.0 once again. Other than a bright spot in French Manufacturing recovering to just above 50.0, Euro-zone advance Purchasing Managers Indices were roundly weaker than expected, as was a US Manufacturing figure. And both CBI UK Total Orders and Selling Prices were negative at well below estimates.

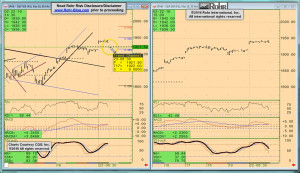

So what could March S&P 500 future possibly do Monday morning in the wake of all that? Well, of course, it gapped almost $20 higher on the opening to leave an early daily low five dollars above the 1,927 previous trading high of the rally from back on Thursday. That might seem truly bizarre to the casual observer. Yet those who are familiar with ‘prismatic’ central bank influences understand these ‘bad news is good news’ phases.

The market activity we are witnessing is completely reasonable under the current circumstances. That is due to the concerns over the US Federal Reserve monetary policy being out of synchronization with the other global central banks. Suffice to say for now that this is having the effect of encouraging the equities through fresh perceptions the FOMC might be constrained to limit (or even eliminate) any further planned rate hikes that would have been part of its ‘normalcy bias’ (see our December 16th post on the Fed’s ‘Normalcy Bias’ Continues for more on that from right after the FOMC meeting.)

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of aspects noted above, and the degree to which data remained weak on balance through all of last week right into early this week (except a few bright spots.) That was especially so for very weak German IFO expectations this morning even if the ‘current indications were good. More important later this week are US Durable Goods on Thursday and G20 on Friday.

It moves on to S&P 500 FUTURE short-term at 02:15 and intermediate term view at 05:15, with OTHER EQUITIES from 07:15, GOVVIES beginning at 12:15 (with the BUND FUTURE at 15:45) and SHORT MONEY FORWARDS from 18:15. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 21:00 EUROPE at 22:15 and ASIA at 25:15, followed by the CROSS RATES at 30:00 and a return to S&P 500 FUTURE short term view at 33:45. As this is an especially extensive analysis due to our desire to review the impact of the weaker economic data and central bank influence at some points, even more so than usual we suggest using the timeline cursor to access analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

2016/02/24 TrendView VIDEO: Concise Highlights (early)

2016/02/24 TrendView VIDEO: Concise Highlights (early)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Wednesday, February 24, 2016 (early)

While we have noted of late that equities were rallying on an ‘abysmal news is good news’ influence from so much serial weak economic data. There is little doubt that outside of a few select bright spots (mostly US) the overall economic data has indeed been abysmal. That continued into this week on weaker Chinese MNI February Business Indicator dropping back below 50.0 once again. Other than a bright spot in French Manufacturing recovering to just above 50.0, Euro-zone advance Purchasing Managers Indices were roundly weaker than expected, as was a US Manufacturing figure. And that even carried over to the US Tuesday on Home Prices and especially both Consumer Confidence and Richmond Fed Index.

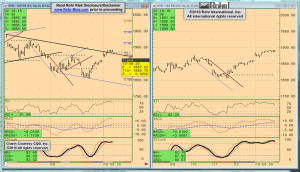

So after March S&P 500 future gapped higher almost $20 higher Monday morning on the opening to overrun last Thursday’s 1,922 short-term DOWN Break as well as the overall congestion in the 1,925-32 range. Yet there was one factor that spoke of broader global weakness than the equities can reasonably absorb after dropping back down to that Negated 1,922 DOWN Break early Tuesday morning: the return to extensive Crude Oil weakness on the back of Iranian rejection of attempts to cap production in the near-term.

While this was not necessarily unexpected, it still hit the NYMEX front month April Crude Oil future hard enough to send ripples through the other asset classes. It had dropped two dollars from the upper 33.00 area Monday to below 32.00 by Tuesday's Close, and is off more than another full dollar at 30.75 this morning. It will be very important for the other markets also to see if it can stabilize that no worse than 30.00.

[NOTE: Full Market Observations update below this morning’s video analysis.]

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of aspects noted above, and the degree to which data remained weak on balance through all of last week right into this week (except a few US bright spots.) That was especially so for very weak US Consumer Confidence and Richmond Fed Index Tuesday morning, as well as very weak Australian even if the more important influences this week are US Durable Goods on Thursday and G20 on Friday.

It moves on to S&P 500 FUTURE short-term view at 02:45 and intermediate term at 05:45, and then only mention of OTHER EQUITIES from 08:15 and GOVVIES from 10:00 including the BUND at 10:45 and SHORT MONEY FORWARDS from 11:45. Foreign exchange also only mentions the US DOLLAR INDEX at 12:15, Europe at 12:45 and ASIA at 14:30, with only mention of CROSS RATES remaining steady yet with a firm euro (especially against sterling) at 15:45 prior to returning to the S&P 500 FUTURE short term view at 16:15.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...