2016/03/02 TrendView VIDEO: Global View (early)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Wednesday, March 2, 2016 (early)

What has changed to some degree is the overall soft global economic data remains while the US data has improved to a goodly degree ever since last Thursday morning’s strong US Durable Goods Orders. The same was true for Tuesday morning’s weak global Manufacturing PMI’s and other data into above-estimate US ISM Manufacturing and Construction spending. This morning also saw the ADP Employment number come in at almost 30,000 above estimate. That will have some analysts revising their Friday US Employment report Non-farm Payrolls number up from the initial 185,000 (the exact same estimate out there for the ADP number prior to this morning’s release.)

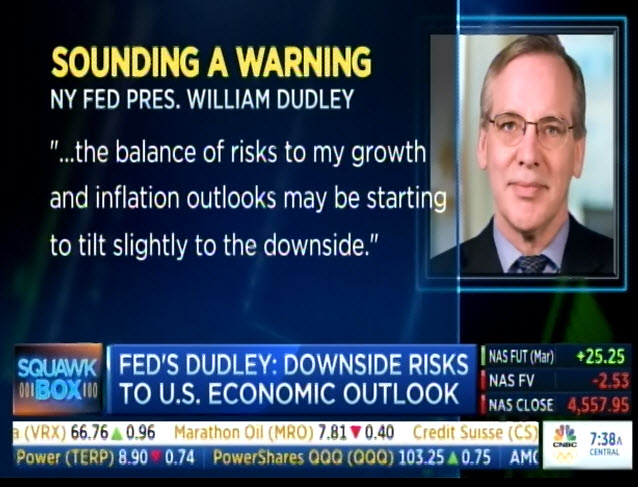

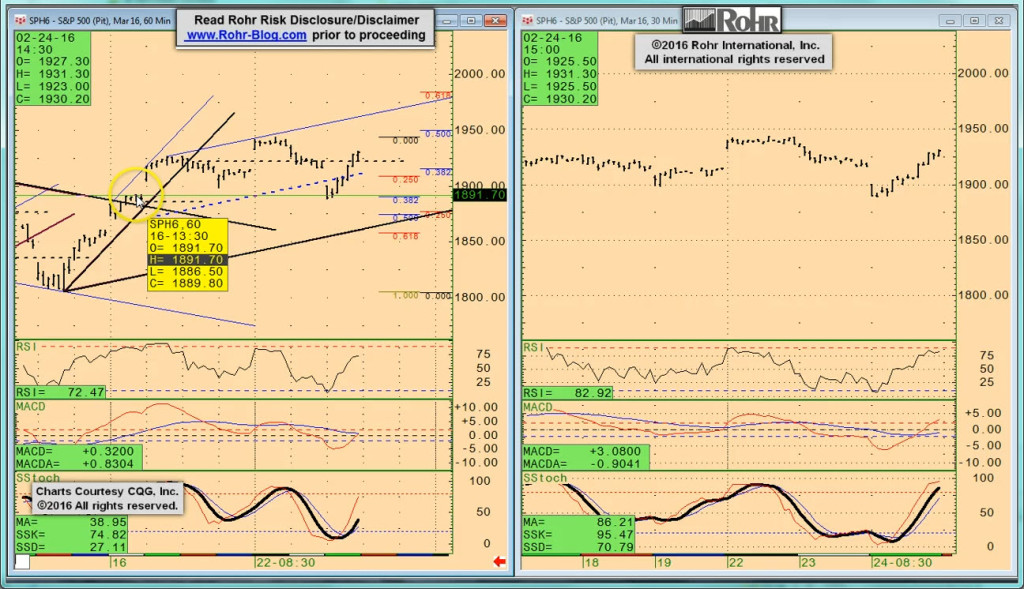

The point of all this is the degree to which the March S&P 500 future has shifted from the threat of a very negative bear extension three weeks ago into 1,805. It is now into a sustained rally that is almost in a ‘Goldilocks’ matrix: weak offshore data restrains the Fed right into the improved US economic indications. While this has been true since last week, the reason we note it now is the Federal Reserve Beige Book release at 13:00 CST today. It should be very interesting to see what the districts have to say.

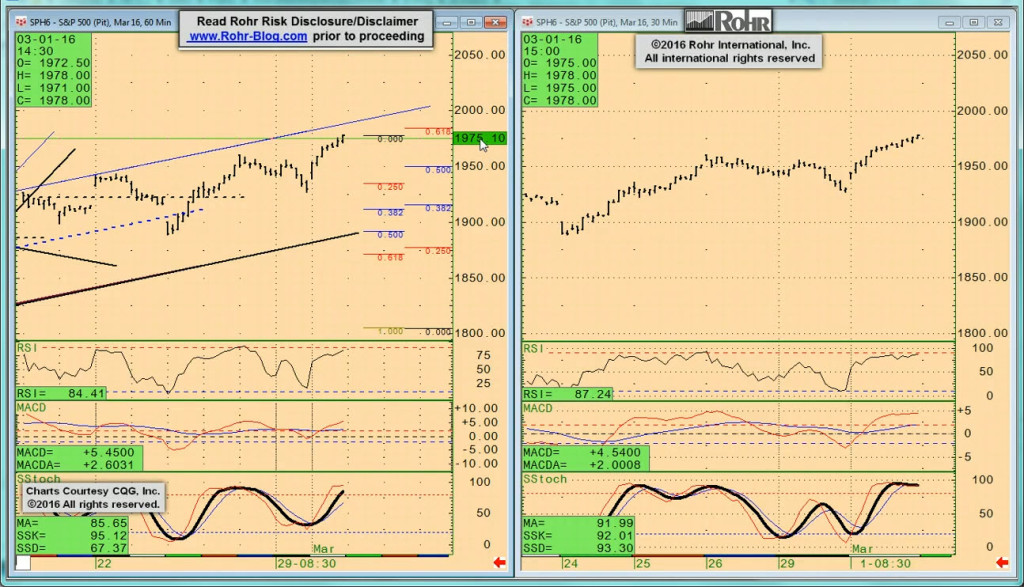

With March S&P 500 future out above the interim 1,958-62 area on Tuesday morning it is important to note the next major resistances are 1,970-75 and 2,010-20. That said, there are interim levels at 1,986 (top of gap up to Wednesday January 6th Close) and the 1,995 bottom of another early January gap. We suspect that it can pull back to 1,962-58 or even somewhat lower in the near term. Yet with another relatively upbeat US Employment report expected Friday, it will likely be hard for it to remain down selloffs in front of it.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of some aspects noted above, and the degree to which international data remains weak even as some US data has improved quite a bit. That was especially so for still weak global Manufacturing PMI’s Tuesday even as US ISM Manufacturing and Construction Spending were stronger. The release of the Beige Book today will be interesting, even if the overall market decisions will not be clear until after Friday’s US Employment report.

It moves on to S&P 500 FUTURE short-term at 03:15 and intermediate term view at 05:45, with OTHER equities from 07:30, GOVVIES beginning at 12:00 (with the BUND FUTURE at 14:45 including mention of the expiration rollover implications into next Tuesday) and SHORT MONEY FORWARDS from 18:00. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 21:15 EUROPE at 22:45 and ASIA at 26:45, followed by the CROSS RATES at 29:45 and a return to S&P 500 FUTURE short term view at 32:45. We suggest using the timeline cursor to access analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

2016/03/04 TrendView VIDEO: Concise Highlights (early)

2016/03/04 TrendView VIDEO: Concise Highlights (early)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Friday, March 4, 2016 (early)

What remains the case now to a goodly degree is the overall soft global economic data while the US data has improved ever since last Thursday morning’s strong US Durable Goods Orders. The same was true for weak global PMI’s (including French Services on Thursday) and other data into above-estimate US ISM Manufacturing and Construction spending Tuesday. And Wednesday’s strong ADP Employment at 30,000 above estimate has now been vindicated by US Employment report Non-farm Payrolls number. Yet here as well, the ‘Goldilocks’ (i.e. data ‘not too hot and not too cold’) rally in US equities (which are leading the others higher) has been reinforced now by even the US data.

While a 242,000 Non-farm Payrolls gain was indeed well above the plus 198,000 estimate, the -0.10% Monthly Hourly Earnings was a real disappointment in that context. There was a lot of hope that last month’s +0.50% Hourly Earnings was a new dawn in earnings gains. In the event the two month average drops right back down to the paltry 0.20% gains that were about the best the US economy did over the past year-and-a-half.

The point of all this is the degree to which the March S&P 500 future has shifted from the threat of a very negative bear extension three weeks ago into 1,805. Out above the interim 1,958-62 area on Tuesday morning it is important to note the next major resistances are 1,970-75 and 2,010-20. Holding at no worse that the top of the lower of those on Thursday morning leaves the bulls in charge. We suspect that it can pull back to 1,975-70, with a Tolerance to Wednesday morning’s 1,967 low. It is also important to note the interim resistance at the 1,995 bottom of another January gap. But the trend remains up.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of some aspects noted above, and the degree to which international data remains weak even as some US data has improved quite a bit. That was especially so for still weak global Manufacturing PMI’s Tuesday even as US ISM Manufacturing and Construction Spending were stronger. Wednesday’s Beige Book was a typically mediocre yet positive view, and Thursday somewhat weaker than expected US Services PMI is also actually constructive in the context of the Goldilocks equities psychology right now.

It moves on to S&P 500 FUTURE short-term view at 03:30 and intermediate term at 06:00, and then only mention of OTHER EQUITIES from 08:30 and GOVVIES from 09:30 including the BUND at 10:45 and SHORT MONEY FORWARDS from 11:45. Foreign exchange also only mentions the US DOLLAR INDEX at 12:30, Europe at 13:30 and ASIA at 14:30, with only mention of CROSS RATES remaining steady yet with a firm euro (especially against sterling) at 16:30 prior to returning to the S&P 500 FUTURE short term view at 16:45.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...