2016/07/06 Commentary: Brexit Bites

© 2016 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY (Non-Video): Wednesday, July 6, 2016

Brexit Bites

Our title is obviously the slang version of what Bank of England Governor Carney had to say yesterday on the return of the negative Brexit implications after last week’s post-Brexit LEAVE vote equities bounce. At the press conference after the release of the BoE Financial Stability Report he noted that the financial risks of Brexit “have begun to crystalise” and the Bank will be doing everything possible to offset any of the more pernicious effects. Yesterday’s excellent Financial Times article dissecting the most salient aspects of the BoE report (our mildly marked up version) also noted that the Bank had suspended the banks’ special buffer buildup to liberate £150B for possible loans. The other obvious aspect to informed observers that was worth stating is that any “…slowdown in credit will be demand driven, not supply driven.” Carney went on to note that based on the major bolstering of bank balance sheets since the financial crisis there is no lack of liquidity or credit.”

Our title is obviously the slang version of what Bank of England Governor Carney had to say yesterday on the return of the negative Brexit implications after last week’s post-Brexit LEAVE vote equities bounce. At the press conference after the release of the BoE Financial Stability Report he noted that the financial risks of Brexit “have begun to crystalise” and the Bank will be doing everything possible to offset any of the more pernicious effects. Yesterday’s excellent Financial Times article dissecting the most salient aspects of the BoE report (our mildly marked up version) also noted that the Bank had suspended the banks’ special buffer buildup to liberate £150B for possible loans. The other obvious aspect to informed observers that was worth stating is that any “…slowdown in credit will be demand driven, not supply driven.” Carney went on to note that based on the major bolstering of bank balance sheets since the financial crisis there is no lack of liquidity or credit.”

Yet we must note that something we have been focused on since early last year and especially since we noted it more specifically once again in our February 9th Fear & Loathing in Marketland post:

The next financial crisis will occur when the investment and portfolio management community (and ultimately the investing public) realizes that the central banks alone cannot restore the robust growth from prior to the 2008-2009 financial crisis.

There has been a steadily increasing call from credible NGO’s like the OECD, IMF, World Bank and others to end global governments’ focus on strict fiscal balance in favor of what are also very pressing infrastructure and other investments.

As we have noted since the obviously negative effects of the BoJ’s negative interest rate policy, the central banks hitting the end of the very distended line on the potential for lower interest rates to stimulate economic growth. We have suggested of late that it might not be long before the central bankers decide it is time to hold the politicians’ feet to the structural reform fire. Along with fiscal stimulus that time seems to have arrived. This is not necessarily a huge surprise after Mario Draghi’s recent backlash German politicians after their mindless criticism of low interest rates. He rightfully noted central banks would much rather be fighting inflation if the politicians could enact policies to stimulate growth.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

2016/07/08 Commentary: US Jobs Explosion?

2016/07/08 Commentary: US Jobs Explosion?

© 2016 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY (Non-Video): Friday, July 8, 2016

US Jobs Explosion?

150,000 job gains per month is not the sort of figure that supports the idea the US economy will expand further after the GDP recovery into Q2 from another weak Q1. Ultimately it is all about the corporate earnings situation. Companies earning more money tend to hire and pay workers more. Yet it is clear at present that the US economy is in somewhat of a corporate earnings recession, and they are due to slip further in coming months. Monthly Hourly Earnings slipping back to just 0.10% is also a weak sign.

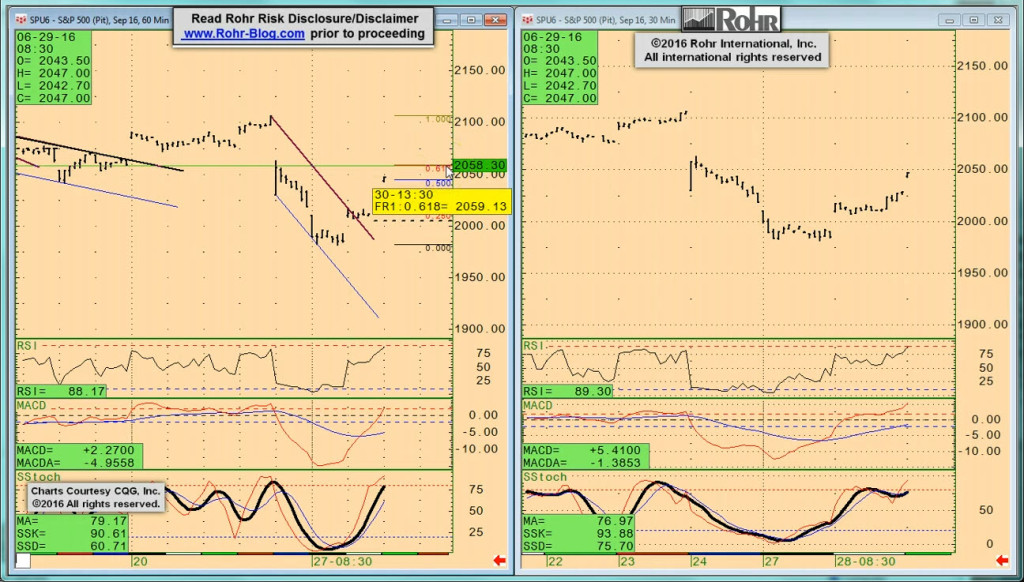

This is with due respect for the immediate strength of the equities in the wake of the numbers. The September S&P 500 future pushing up through its recent 2,105 trading high is impressive at first glance. Yet there are still higher resistances, and it will be interesting to see if it maintains its strength above 2,105 as the session proceeds. The govvies shrugging their collective shoulders at such a strong US NFP is also a sign that the markets may not be taking this huge swing back up in jobs from such a weak May number very serious. While the US may be among the healthiest economies in an otherwise weak world, there is not much sense it can lead the other higher.

In addition to the UK Brexit uncertainty and pressures, there is the recent slippage in the fundamental indications outside of this morning’s strong US NFP. And all of that data was collected prior to the UK Brexit vote. The Japanese Leading Index was weaker than expected along with German Industrial Production, even if UK Industrial Production was better than expected. However, the Japanese Trade Balance was weaker than an already low estimate with a very soft Japan Economy Watchers Survey. A weaker than expected German Trade Balance was troubling due to the very weak Exports figure. We have been noting for some time the troubling nature of weaker than expected global trade.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

Read more...