2013/11/25: Technical Projections and Select Comments (as of Friday’s US Close)

© 2013 ROHR International, Inc. All International rights reserved.

Technical Projections and Select Comments: Monday, November, 25, 2013 (as of Friday’s US Close)

[The Weekly Report & Event Calendar is available via the link in the sidebar]

Current Rohr Technical Projections - Key Levels & Select Comments

We have elected to hold off on the typical weekend global multi-asset class TrendView Video analysis. That is due to the very slow economic data today at the top of a very robust week. It is also the case that all markets are following through on our very extensive Friday morning multi-asset class TrendView Video analysis. You can go scroll down to see that if you are a Gold or Platinum subscriber.

Even for those of you at the Silver and Sterling subscription levels, our Friday afternoon 'It’s the Fed PR, stupid' post is the definitive extension of our opinion on why there will be NO QE taper until at least Dr. Yellen’s first meeting as Chairman in March.

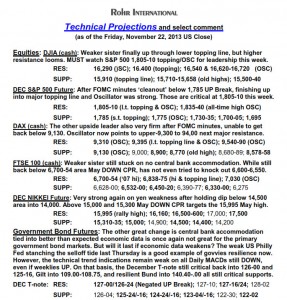

And that underscores the market tendencies we have been discussing in the TrendView Videos of late, and especially the Thursday-Friday major decision by the Asian currencies. In a nutshell, the obviously continuing central bank accommodation has been very good for equities. December S&P 500 future is pushing up into the key low-1,800 resistance, with 1,835-40 next major resistance if it escapes.

That same QE-Infinity (regardless of whether the data improves into next month) is not so good for the US Dollar Index (with the exception of the yen and Aussie now being the co-weak sisters.)

It is also problematic for the fixed income pending further economic data. This is back to classic ‘good news is bad news’ and vice versa. Note how weak US data is helping a bit from last Thursday’s Philly Fed into today. That’s how the December T-note future was rescued from its test of the higher of the 126-00 and 125-16 supports last Thursday.

All of which is also explored in the attached technical projections and comments. We look forward to providing the typical early week global multi-asset class TrendView Video analysis after the US Close today.

Thanks for your interest.

2013/11/26: TrendView VIDEO Analysis: Equities, Fixed Income, FX (early)

2013/11/26: TrendView VIDEO: Equities, Fixed Income, FX (early)

© 2013 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Tuesday, November, 26, 2013 (early)

The video timeline begins with macro (i.e. fundamental influences) discussion of the degree to which the markets (especially foreign exchange) are much more focused on a revisit to our view that QE-Infinity will continue until Janet Yellen’s first meeting as Chairman in March (see Friday’s It’s the Fed PR, stupid post.) That means the equities see good news as good news and bad news as not so bad. Quite bullish for equities on balance, even if more problematic for the govvies and foreign exchange. There is also discussion of the important accelerated economic data release Wednesday into the US Thanksgiving holiday. And after we recorded the video it was announced that US Housing Starts due out at 07:30 CST will be delayed based on the US government shutdown disruption… until December 18th!!

Back to the timeline, the macro factor discussion is followed by the short-term December S&P 500 future trend viewat 04:45 and intermediate-term at 06:45, then the other equities from 09:35, with govvies analysis beginning at 13:15, and short money forwards at 16:45. Onto the foreign exchange with the US Dollar Index at 18:00, jumping over to Europe at 19:55 and Asia at 22:35, followed by the cross rates at 22:30 and a return to the December S&P 500 future for short term charts and summary comment at 30:30.

[The Weekly Report & Event Calendar is available via the link in the sidebar]

The TrendView VIDEO ANALYSIS & OUTLOOK video is accessible below.

Authorized Gold and Platinum Subscribers Click ‘Read more’ to access TrendView Video Analysis

Read more...