Great Fedspectations or Just Speculations?

One more good reason the Fed won’t taper until March

…and it is something we would never have guessed!

© 2013 ROHR International, Inc. All International rights reserved.

COMMENTARY: Friday, November 29, 2013 Weekend Read

As we noted last Friday, there are still quite a few folks bothering to analyze the likelihood of Fed QE taper in December. Not only have we pointed out all the reasons that is likely silly, there was a new one presented by a very knowledgeable and reliable source just this week. Kevin Warsh is an ex-Fed governor and all around knowledgeable individual on central bank activity and psychology.

He recently cohosted CNBC Squawk Box, and there was naturally quite a bit of discussion of the Fed QE taper possibilities. As we have noted in our previous assessments, the bottom line is there will be no QE taper until Janet Yellen’s first meeting as Chairman in March. Period.

He recently cohosted CNBC Squawk Box, and there was naturally quite a bit of discussion of the Fed QE taper possibilities. As we have noted in our previous assessments, the bottom line is there will be no QE taper until Janet Yellen’s first meeting as Chairman in March. Period.

And now there is what Warsh said that we would never have guessed. Nor would most other commentators, even though it is glaringly apparent. And we found it as disconcerting as anything else we have mentioned that gives us significant pause on the overall Fed QE-Infinity program. But the new, troubling reason for no near term QE taper is…

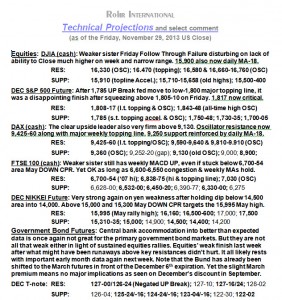

[The Current Rohr Technical Projections - Key Levels & Select Comments are available via the link in the right-hand sidebar]

[Holiday Weekend exception to FREE Silver subscription to 'Read more'}

…that the Fed may have serious doubts on the reliability of its own forecasts!! And how could it not? It is the beast that nobody dare speak its name. Yet Warsh lays it out in the most straightforward fashion how this has been a problem not just for the past several quarters, but consistently ever since the 2008-2009 crisis.

The Fed forecasts have been miserably misguided. And mostly in expecting the reversion to mean economic trend which has just not shown up, even in the wake of such massively expanded and maintained QE since the initial enlightened effort back in 2009. Think about it… a Fed balance sheet north of $3 trillion headed for $4 trillion and US economic growth remains (on average) stuck in the low 2.0% area. (For more details on why that might be, see QE-Infinity II: Contained Depression from back on November 1st.)

So that’s it. We promised it would be short and sweet for the Thanksgiving holiday weekend, and the video clip speaks for itself not just on that lack of Fed forecast reliability. It also notes one more issue that amplifies that additional incentive to avoid any near term QE taper…

Our Conclusion is reserved for Gold and Platinum subscribers...

Conclusion (we have waived the higher level subscription requirement for this Holiday Weekend only.)

…insofar as Janet Yellen may be no more dovish than Ben Bernanke in general, but is definitely more committed to respecting the model. The model has been wrong in expecting that post-WWII reversion to median growth of approximately 3.0% or higher.

So it stands to reason that a model-driven Fed Chairman is going to have a real issue with moving prior to the actual growth showing up in the economy if their preferred perspective on the monetary accommodation and rates structure has not been reliable. It is not just a matter of whether Dr. Yellen will taper at her first meeting as Chairman in March…

…when can she ever taper QE short of overall signs that growth (and as the Fed has made clear of late, NOT just employment) is finally accelerating? And as any informed observer of central bank theory and practice knows, by the time accelerated growth is glaringly apparent, monetary policy is likely to be way behind the inflation curve.

It really does make the whole Fed QE-Infinity program expansion to such massive proportions appear more so speculation than any sort of expectation. Then again, as we noted last week, even Warren Buffet sees the QE-Infinity program as having turned the Fed into The Greatest Hedge Fund in History.

Thanks for your interest.

Current Rohr Technical Projections - Key Levels & Select Comments available in the sidebar

Current Rohr Technical Projections - Key Levels & Select Comments available in the sidebar

2013/12/03: TrendView VIDEO Analysis: Equities, Fixed Income, FX (early)

2013/12/03: TrendView VIDEO: Equities, Fixed Income, FX (early)

© 2013 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Tuesday, December 3, 2013 (early)

EQUITIES, FIXED INCOME & FX

The video timeline begins with macro discussion of the degree to which the market behavior is still consistent with our view that QE-Infinity will continue until Janet Yellen’s first meeting as Chairman in March (see last Friday’s Great Fedspectations or Just Speculations post. That means the equities see good news as good news and bad news as not so bad... or is that changing in certain areas?

Yet at least up to now, that has been quite bullish for equities on balance, even if more problematic for govvies and foreign exchange. After Wednesday’s accelerated end-of-month pre-Thanksgiving holiday US economic data release was better-than-expected on balance, especially equities and govvies seemed to be dancing to that tune… equities liked it (good news is good news) and the govvies did not (good news is bad news). Yet whether that is continuing at present is subject to further review in the wake of equities weakness and govvies holding in once again.

Back to the timeline, the macro factor discussion is followed by the short-term December S&P 500 future trend viewat 03:30 and intermediate-term at 06:10, then the other equities from 08:30, with govvies analysis beginning at 13:05, and short money forwards at 19:30. Onto the foreign exchange with the US Dollar Index at 22:00, jumping over to Europe at 24:00 and Asia at 27:20, followed by the cross rates at 31:50 and a return to the December S&P 500 future for short term charts and summary comment at 35:05. We appreciate this is longer than usual, yet important to set up the Evolutionary Trend View (ETV) for the indicators and projections early this week.

[The Weekly Report & Event Calendar is available via the link in the sidebar]

The TrendView VIDEO ANALYSIS & OUTLOOK is accessible below.

Authorized Gold and Platinum Subscribers Click ‘Read more’ to access TrendView Video Analysis

Read more...