2013/12/06: TrendView VIDEO: Equities, Fixed Income, FX (early)

© 2013 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Friday, December 6, 2013 (early)

EQUITIES, FIXED INCOME & FX

EQUITIES, FIXED INCOME & FX

The video timeline begins with macro (i.e. fundamental influences) discussion of the degree to which the market behavior is still consistent with our view that QE-Infinity will continue until Janet Yellen’s first meeting as Chairman in March (see last Friday’s Great Fedspectations or Just Speculations.)

That means the equities see good news as good news and bad news as not so bad. They seem to remain bullish under all circumstances... the pullback has been limited so far.

Yet that is in play as we head into the US Employment report this morning. As such, we will likely get a further insight into whether the equities still see ‘good news is good news’ if the markets get the expected 185,000 gain or better on US Non-Farm Payrolls. Of course, the govvies would likely be just the opposite, as classically and on recent form ‘good news is bad news’.

However, there is one more wild card if the number is strong. What if US 10-yr T-note yields push above 3.00%? In other words, any initial December T-note future drop below the 125-16 level we have focused on for some time would look fairly ugly. That said, would it be enough of a ‘yield scare’ to drop the December S&P 500 future below the significant 1,770 short term trend support? And there you have the key consideration of the equities-govvies interplay on this very important trend decision day.

Back to the timeline, the macro factor discussion including the potential impact of the central US ice storm is followed by the short-term December S&P 500 future shot-term trend viewat 03:00 and intermediate-term at 05:10, then the other equities from 06:20, with govvies analysis beginning at 09:35, and short money forwards at 15:25. Onto the foreign exchange with the US Dollar Index at 17:50, jumping over to Europe at 19:00 and Asia at 20:15, followed by the cross rates at 23:20 and a return to the December S&P 500 future for short term charts and summary comment at 26:45. We appreciate this is still rather long, yet necessary into the US Employment report. We suggest making use of the timeline to access the key market analysis you desire.

[The Weekly Report & Event Summary Perspective is available via the sidebar]

The TrendView VIDEO ANALYSIS & OUTLOOK is accessible below.

Authorized Gold and Platinum Subscribers Click ‘Red more’ to access TrendView Video Analysis

Read more...

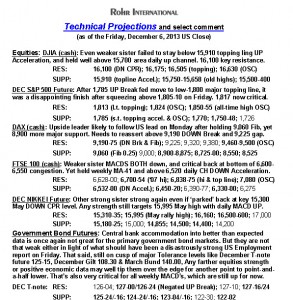

Technical Projections and Select Comments: Sunday, December, 8 2013 (as of Friday’s US Close)

Technical Projections and Select Comments: Sunday, December, 8 2013 (as of Friday’s US Close)

2013/12/10: TrendView VIDEO Analysis: Equities, Fixed Income, FX (early)

2013/12/10: TrendView VIDEO: Equities, Fixed Income, FX (early)

© 2013 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Tuesday, December 10, 2013 (early)

We waited until this morning to incorporate the overnight Asian and European data, which ended up being mixed… and that is reflected in the lackluster equities activity and continued resilience in the govvies. Note the timeline also specifies the discussion of the T-note and Gilt futures’ expiration rollover implications in that section. Foreign exchange remains the same strong Europe versus strong Asia affair.

The timeline opens with the macro (i.e. fundamental influences) factor discussion including the mixed international data (the US ice storm has been discussed in Saturday’s Commentary blog post), and is followed by the December S&P 500 future short-term trend view at 01:15 and intermediate-term at 02:40, then the other equities from 04:00, with govvies analysis beginning at 08:40 with discussion of the importance of the T-note and Gilt expiration rollovers from 10:40, and short money forwards at 16:15. Onto the foreign exchange with the US Dollar Index at 18:55, jumping over to Europe at 20:20 and Asia at 22:40, followed by the cross rates at 25:50 and a return to the December S&P 500 future for short term charts and summary comment at 30:30.

[The Weekly Report & Event Calendar is available via the link in the sidebar]

The TrendView VIDEO ANALYSIS & OUTLOOK is accessible below.

Authorized Gold and Platinum Subscribers Click ‘Read more’ to access TrendView Video Analysis

Read more...