2014/01/03: TrendView VIDEO: Global View (early)

© 2014 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Friday, January 3, 2014 (early)

First of all, Happy New Year to All on our return from holiday.

The first thing to keep in mind on the top-of-the-year swings in the various asset classes is the degree to which these are limited reactions in the context of the late year extensions of prevailing trends. That is most apparent in the March S&P 500 future not yet slipping back below the 1,822 UP Acceleration or 1,814.50 gap below it.

The video timeline begins with macro factors on early year reinvestment, the degree to which economic data remains nominally firm, and the Chinese central government has decided to approve local authority debt rollovers as a way to avoid any potential crisis in that now sensitive area. It moves on from there to the March S&P 500 future short-term trend view at 03:30 and intermediate-term at 05:25, then the other equities from 07:40, with govvies analysis beginning at 11:05 and short money forwards at 17:30. Foreign exchange begins with the US Dollar Index at 21:40, jumping over to Europe at 24:05 and Asia at 27:00 with a view of the longer-term trend levels (i.e. monthly charts) for Japanese yen, followed by the cross rates at 30:55, and a return to the March S&P 500 future for short term charts and summary comment at 35:15. We suggest using the timeline cursor to access the analysis most relevant for you.

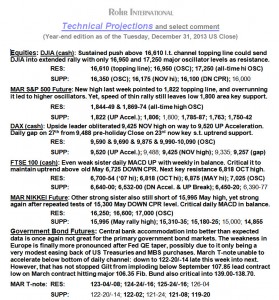

[The Current Rohr Technical Projections - Key Levels & Select Comments from after Tuesday’s US end-of-year Close are available via the sidebar]

The TrendView VIDEO ANALYSIS & OUTLOOK is accessible below.

Authorized Gold and Platinum Subscribers Click ‘Read more’ to access TrendView Video Analysis

2014/01/06: Commentary: El-Erian says technicals count

El-Erian says technicals count

The PIMCO CEO allows for focus on psychological

aspects due to 2014 uncertainties beneath the calm

© 2014 ROHR International, Inc. All International rights reserved.

COMMENTARY: Monday, January 6, 2014

PIMCO is known for insightful perspectives on the fundamental trends behind the global markets, and deft position adjustment timing that has led to significant returns over many years. While it was wrong-footed by the timing of the Federal Reserve QE taper last year, the opinions of its most vocal principals is still well-regarded. That includes both founder Bill Gross and his CEO and co-CIO Mohamed El-Erian.

And the latter was on CNBC this morning (full interview linked via the picture above) expressing his views on why the very sanguine bullish assumptions for the equity markets this year still leave room for some concerns… and a particularly interesting take on what to look at: including the technical trend aspects. Which is to say (as we always note) that the psychological aspects on where the equities hold trend support are going to be critical in a year with so much built-in bullish anticipation.

Little doubt that opposed to last year, most observers and analysts are friendly to the global equities based on the idea the US economy and equities will pick up momentum and lead the rest of the world up. El-Erian does not necessarily disagree, and yet points out that all of those friendly assumptions on energy prices, US employment, China performing passingly well, etc. are already mostly reflected in current market pricing. And with so many analysts and portfolio managers expecting the combination of those factors to reflect further economic data improvements that will drive the increase in stock prices, might it indeed be a credible foregone conclusion?

Read more...