2015/05/02 Extended Perspective

© 2015 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments are reserved for Gold and Platinum Subscribers

Extended Perspective: Saturday, May 2, 2015

Tail Risk is Back!

Thursday’s TrendView Global View video analysis and the General Update Market Observations from after the US Close remain the relevant fundamental views and trend assessments. Yet it is important as April draws to a close to consider the bigger picture on evolving fundamental influences after the attendant market activities across all asset classes were so telling last week. As we head into what will be even more critical economic data releases in May for the beginning of the second quarter, a key question will be more prominent than previous: Is the Q1 US economic weakness seasonal or structural?

Since early last year we have been questioning whether all of the central bank Quantitative Easing (QE) and extended accommodation were even capable of restoring robust economic growth. On recent form, the evidence is mounting it cannot. (More on that below.)

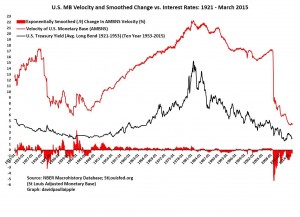

As much as it is atypical to accompany our commentary with an opening economic indication graph, this one seems appropriate at this particular moment. With equity market sentiment still quite strong on the back of all the previous and current central bank QE (‘bad news is good news’) psychology, consider for a moment the appalling lack of velocity in the US Monetary Base. (If you wish to remain within the post, right click on the graph and ‘Open link in a new window’ to see the full size and scalable version.)

Velocity includes many factors. Yet most importantly it represents the degree of the use of money in circulation in transactions relative to the size of the monetary base. If economic activity is suppressed by various factors, the velocity of money can be much lower than expected, creating a negative feedback loop for overall economy. This is from the St. Louis Fed’s economists last September:

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options and join us. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

2015/05/04 TrendView VIDEO: Concise Highlights (early)

2015/05/04 TrendView VIDEO: Concise Highlights (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Monday, May 4, 2015 (early)

After the One-Two Punch hit that hit the govvies two weeks ago (BoE minutes-US Existing Home Sales), the end of bullish assumptions had a coup de grâce on last Wednesday’s extension of the recent selloff into an even sharper loss. That was after a rise of Euro-zone CPI from -0.1% in March to 0.0% for April reported last Wednesday morning. Not exactly an inflationary conflagration, but enough to derail the negative inflation anticipation over the past couple of sessions.

While we have more on the technical trend implications below in the video (and last Thursday’s Market Observations), it is also important to note that the energy price increase will also not necessarily be as good for the overall economic activity as had been presumed at the recent lower levels. And this is into economies which are not necessarily thriving at present. So while the govvies have been knocked by the less deflationary environment, the overall weakness is highlighted by the slippage in the US dollar. On that front last Wednesday’s FOMC statement was not necessarily very encouraging either.

While allowing it all might be due to ‘transitory’ factors, it provided chapter and verse on “Business fixed investment softened, the recovery in the housing sector remained slow, and exports declined” along with “…growth and output slowed during the first quarter...” Even in the context of the first quarter being classically weak (even though the ‘seasonal adjustments’ are supposed to offset that in the data releases), there remains the question over whether all of the QE is really working? We suggest review of our broad EXTENDED PERSPECTIVE: Tail Risk is Back! post from the weekend for much more on that.

It provides extensive further exploration of why the US and global Q2 economic data will be so critical. If indeed the Q1 numbers were distorted and the type of rebound seen in Q2 2014 is going to repeat, then the data released in May should reflect that right away. However, if those numbers are still weaker than expected, there is a significant degree of equities tail risk on any indication fears all the QE is will not restore strong growth.

_____________________________________________________________

Video Timeline: It begins with a macro (i.e. fundamental influences) mention of some of the factors noted above. It also notes that Asian data has remained mostly weak with the exception of Friday’s Australian Services PMI, reinforced by weak a Chinese HSBC Non-Manufacturing PMI this morning. Manufacturing PMI’s in Europe were only mixed as we head into US ISM New York, Factory Orders and a goodly bit of Fed-speak.

It moves on to the JUNE S&P 500 FUTURE short-term view at 02:30 and intermediate term at 04:50, and OTHER EQUITIES from 06:30, and GOVVIES at 11:10 (with a concentration on the very critical activity in the BUND from 14:20) with only mention SHORT MONEY FORWARDS at 18:00. There is also the US DOLLAR INDEX at 19:00 with only mention of EUROPE and ASIA at 20:20 and CROSS RATES at 21:40 prior to returning to the JUNE S&P 500 FUTURE short term view at 22:00 for a final look.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...