2015/06/24 TrendView VIDEO: Concise Highlights (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Wednesday, June 24, 2015 (early)

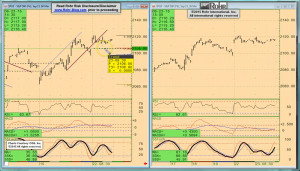

Only Concise Highlights on the September S&P 500 future today along with the September Bund future, mention of the other equities and govvies and the foreign exchange this morning. That is because Tuesday morning’s Global View TrendView video on equities improving since Monday on the constructive turn in the Greek Debt Dilemma negotiations has all the technical trend views to effectively assess those other markets. And the General Update Market Observations below the video in Tuesday’s post were updated this morning specifically to allow for a next twist in the Greek tragedy.

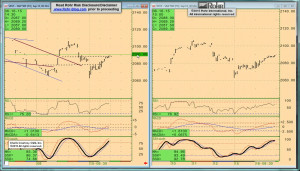

And we are indeed glad we waited, as the talks have had a reversal once again. It seems the EU/ECB/IMF negotiators were not that impressed with proposed accelerated reforms from the Greek government. So it is back to a bit of ‘risk-off’ showing up in the weakening of equities and firmness of the govvies that still relate back to tendencies noted in both the atypically technical discussion early in yesterday’s post and the extended comments.

And some of the most interesting activity has been in the September Bund future that is the most critically affected by the further developments on the Greek negotiations. It was also folly to presume that the somewhat more acceptable set of reforms offered by the Greek government late in the game (relative to a deadline for its next IMF loan repayment) early Monday morning would solve the problems. Even if Troika members had accepted them instead of sending back their amended form, Greek PM Tsipras would still need to sell them to a surly Greek Parliament. While other delays (like acceptance by the German Parliament as well) could be allowed, if the Greek legislature is not going to approve them the whole effort breaks down. We haven’t seen the last of this round of the crisis.

_____________________________________________________________

Video Timeline: It begins with a macro (i.e. fundamental influences) mention of some of the factors noted above along with the degree to which some data is weak again even as US Housing indicators strengthen. Those include items ranging from Monday’s Japanese Convenience Store and Supermarket Sales to this morning’s German IFO readings. And US Q1 GDP only improved a bit (to still negative levels) this morning.

It moves on to the S&P 500 FUTURE short-term view at 02:30 and intermediate term at 06:00 with only mention of OTHER EQUITIES from 08:45 and GOVVIES at 10:00 yet with an actual look at the still very critical BUND from 10:45, and mention of SHORT MONEY FORWARDS at 14:45. Foreign exchange is also only mentioned, beginning with the US DOLLAR INDEX at 15:15, Europe at 16:15, ASIA at 17:00 and CROSS RATES at 17:45 prior to returning to the S&P 500 FUTURE short term view at 18:00 for a final look.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

2015/06/25 TrendView VIDEO: Global View (early)

2015/06/25 TrendView VIDEO: Global View (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Thursday, June 25, 2015 (early)

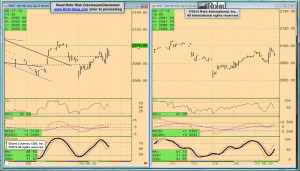

‘Wild and Crazy’ markets continue (except maybe foreign exchange), yet really not so crazy after all. In fact, recent gyrations have been totally rational and at least somewhat predictable responses to the Greek Debt Dilemma reaching critical dimensions again two weeks ago. Looking like a potential failure into default as late as the end of last week into the swing between the Agony then and the Ecstasy early this week, and back to the Agony again now (with apologies once again to Irving Stone for coopting the name of his great novel.)

In the event the fresh light at the end of the tunnel from Greece’s new proposal on reforms to liberate the major tranche of bailout funding critical to paying a key IMF loan has turned out to be a train barreling down the tracks toward a default. The response was a more rigid Troika request on pension reforms and taxation that will be very hard for Mr. Tsipras to get approved by his Parliament. As things stand now, even if he were to accept it the chances of it passing back in Athens are very slim. As such, unless something changes markedly the markets will likely begin to reflect a Greek failure to pay that IMF loan on time; whether or not that is designated a full technical default is another matter, with some latitude to possibly kick the can just a bit further down the road prior to a full default designation.

_____________________________________________________________

Video Timeline: It begins with a macro (i.e. fundamental influences) mention of some of the factors noted above along with the degree to which some data is weak again even as US Housing indicators strengthen. Those include Monday’s Japanese Convenience Store and Supermarket Sales as well as US CFNAI. Advance Manufacturing PMIs saw some improvement, yet with UK CBI Total Orders very weak along with a still depressed (even if as expected) US Final Q1 GDP after somewhat weak US Durable Goods Orders. Yet even after Wednesday’s weaker than expected German IFO, US Income was as expected with Spending somewhat better as we await US Services PMI and the KC Fed Index.

It moves on to S&P 500 FUTURE short-term indications at 01:15 and intermediate term view at 04:45, OTHER EQUITIES from 06:00, GOVVIES analysis beginning at 10:00 (with the BUND at 12:45) and SHORT MONEY FORWARDS 25:45. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 18:45, EUROPE at 20:45 and ASIA at 23:00, followed by the CROSS RATES at 26:00 and a return to S&P 500 FUTURE short term view at 28:45. We suggest using the timeline cursor to access the analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...