2015/07/02 TrendView VIDEO: Concise Highlights (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Thursday, July 2, 2015 (early)

The response to the US Employment report has been a classical ‘bad news (or at least mediocre news) is good news’ in the govvies, and reasonably positive reaction in the equities as well. Yet this may be due to only transitory factors on the way into the Greek Troika final offer referendum on Sunday. While the govvies are bid for now, any YES vote that is the most likely result of that Sunday referendum (see more on that below) will likely weigh on them once again after quite a bit more upbeat economic indications outside of the Greek Debt Dilemma returning to crisis proportions.

The equities circumspect view of weaker than expected US Employment leaves room for quite a bit more strength if the Greek YES camp prevails. The 223,000 jobs added was in line with the top of the week estimates, yet disappointed after Wednesday’s stronger ADP Employment numbers. And a 60,000 downward revision to previous two months’ Nonfarm Payrolls along with what is likely an even more important reversion to no Hourly Earnings gain after plus 0.30% last month is weighing on equities a bit this morning.

However, this is also grounds for the Fed to consider further delays in its first rate rise in years. And taken in that context, if the Greek drama ends positively on Sunday we suspect the equities will have the same sort of quasi-euphoric response next week as the initial bulge at the top of the week last week. Of course, all of that will be the opposite (equities weakness and govvies strength) if the Greeks come back with a NO vote on Sunday. As we have seen on recent form, that will all be regardless of overall economic data with the potential health of the nascent Euro-zone and broader European recovery in the balance.

_____________________________________________________________

Video Timeline: It begins with a macro (i.e. fundamental influences) mention of some of the factors noted above along with the degree to which some data is weak again even as US indicators strengthen. Those include Asian data and weak UK Manufacturing PMI and House Prices along with slippage in US automobile sales (a previously very strong area.) To that we can now add US Factory Orders on top of modest Employment disappointment.

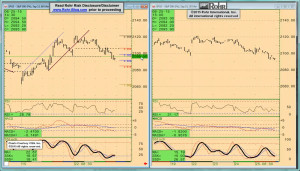

It moves on to the S&P 500 FUTURE short-term view at 02:30 and intermediate term at 05:15 with OTHER EQUITIES from 07:00 and GOVVIES from 10:45, with SHORT MONEY FORWARDS at 10:45. Foreign exchange is only mentioned, beginning with the US DOLLAR INDEX at 19:45, Europe at 21:00, ASIA at 22:00 and CROSS RATES at 23:30 prior to returning to the S&P 500 FUTURE short term view at 24:45 for a final look.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

2015/07/06 TrendView VIDEO: Global View (early)

2015/07/06 TrendView VIDEO: Global View (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Monday, July 6, 2015 (early)

The ‘Greece-d Lightning’ we cited early last week is back, with similar effect in the various asset classes. That’s what equities look like again, yet in a bit more subdued manner than last week, in part because they are starting from quite a bit lower Closes from last week that they were starting out from at the top of last week. And it is of note that the equities are holding with only a bit of further weakness while the govvies are only up into similar sorts of levels (outside of the obvious European haven bid for the Bund.) On the foreign exchange, even the US Dollar Index is only moving higher in a most orderly manner on renewed secular weakness in the euro.

As noted since early last week, the current Greek crisis is not Lehman Brothers, and authorities have had more than enough time to ‘ring fence’ the immediate implications for the broader Euro-zone and global economy. The bigger questions over the place of Greece within Europe, and whether that includes potential withdrawal from the Euro-zone and EU, will wait until further development of events after Sunday’s Greek referendum.

And as noted last Thursday, the seemingly recalcitrant positions of the EC/IMF/ECB Troika leaders were met with commensurate levels of resistance to agree to the previous Sunday’s ‘final’ offer by the Greek government. Compounding factors included the Greek government position that it was lobbying for a NO vote in last weekend’s referendum. It is now obvious that a Troika offer to review the ‘sustainability’ of Greek debt if the Greeks would agree to the ‘final’ terms was not acceptable. So now the cat is loose among the canaries on all manner of questions extending beyond Greece that will only be answered across time, such as those possible exits from the Euro-zone and the EU. We shall see.

_____________________________________________________________

Video Timeline: It begins with a macro (i.e. fundamental influences) mention of some of the factors noted above along with the degree to which some other data is weak again after the US Employment last Thursday. That includes the global Services PMI’s (outside of the UK) and Euro-zone Retail PMI’s. Yet Euro-zone Investor Confidence was strong even as we have now seen a bit weaker than expected US ISM Non-Manufacturing PMI.

It moves on to S&P 500 FUTURE short-term indications at 02:30 and intermediate term view at 04:15, OTHER EQUITIES from 06:00, GOVVIES analysis beginning at 10:45 (with the BUND at 14:00) and SHORT MONEY FORWARDS 16:00. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 19:15, EUROPE at 21:00 and ASIA at 23:30, followed by the CROSS RATES at 26:00 and a return to S&P 500 FUTURE short term view at 28:45. We suggest using the timeline cursor to access the analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...