2015/07/31 TrendView VIDEO: Global View (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Friday, July 31, 2015 (early)

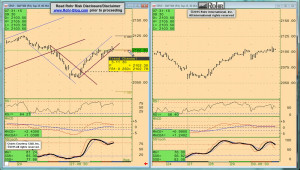

Quite a bit later than usual today, so the response to all of the end of month US data is in the market in along with the extensive international data. And in addition to all that, it is important to note that this week’s Close also represents the extended market response to Wednesday’s FOMC statement and Thursday’s first look at US Q2 GDP. Both of those are important ‘macro’ influences, and at least so far there has not been much change in market activity from our expectations in Wednesday morning’s Global View TrendView video, and Thursday morning’s early update of the text-based Market Observations we provided somewhat prior to the US GDP data release.

And after almost a carbon copy (some referred to it as ‘poker faced’) FOMC statement that only had a slight change allowing some possible further improvement in US employment, there was no clear indication of whether the FOMC will put through the first rate hike in nine years. That left a lot more emphasis on the US Q2 GDP release. And while it was a bit weaker than expected at 2.30%, the Q1 upward revision from -0.20% to +0.60% shook up the govvies (positive Q1!?) for a brief while and temporarily strengthened the equities.

However, Thursday was also the US Bureau of Economic Analysis annual GDP revisions release, and it was negative. Over the previous three years the average downgrade was -0.30% per year. Once that sank in the govvies recovered and the equities took some pressure prior to recovering. The bottom line in market activity is that the September S&P 500 future remains up around the key 2,100 area in spite of the strong Chicago PMI and Michigan Confidence. Yet the govvies got very good news in the significant weakening of US Employment Cost Index this morning. Expected to weaken just a bit from last month’s +0.70%, it came in at +0.20%. Just plain weaker inflation news on US labor costs.

_____________________________________________________________

Video Timeline: It begins with a macro (i.e. fundamental influences) mention of some of the factors noted above along with the degree to which Thursday’s European confidence indicators were upbeat. However, Friday morning brought weak UK Consumer Confidence and Japanese Household Spending, even if Japan’s inflation numbers were up just a bit.

It moves on to S&P 500 FUTURE short-term indications at 02:30 and intermediate term view at 06:30, OTHER EQUITIES from 08:45, GOVVIES analysis beginning at 12:45 (with the BUND at 17:00) and SHORT MONEY FORWARDS 19:30. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 23:15, EUROPE at 26:30 and ASIA at 29:30, followed by the CROSS RATES at 32:15 and a return to S&P 500 FUTURE short term view at 35:00. We suggest using the timeline cursor to access the analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

2015/08/04 TrendView VIDEO: Global View (early)

2015/08/04 TrendView VIDEO: Global View (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Tuesday, August 4, 2015 (early)

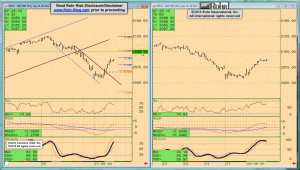

While quite a bit has transpired since Friday, the weak finish of the US equities back then was telling. As noted in a later than usual Friday morning Global View video analysis, last week’s Close represented the extended market response to Wednesday’s FOMC ‘carbon copy’ statement and Thursday’s weaker than expected first look at US Q2 GDP (along with the downward revisions to the previous three years of GDP data.) So while there were upbeat Chicago PMI and Michigan Confidence numbers, Friday had already seen a much weaker US Employment Cost Index, at just +0.20% versus the previous month’s +0.70%. Just plain weaker inflation news on US labor costs that was not consistent with the overall employment picture. That also fit in with the weaker data and outlook elsewhere, at least outside a nominally stronger Europe.

Yet after Friday’s late weakness it was not surprising that the US equities and others should weaken further on Monday in spite of European Manufacturing PMI’s being upbeat as expected. That is because both the Chinese and US equivalent figures were weaker than expected; with China seemingly slipping into a worse contraction than expected.

Whatever anyone would like to believe about the global economy muddling through, China is a major European export outlet. As such, if it weakens more than expected, it is also a headwind for a Europe that is one of the few areas expected to improve over the intermediate term. That is consistent with the most recent (early July) OECD Composite Leading Indicators (that we again provide a link to below.) With much of the rest of the world sinking into cyclical weakness (including North America), if the Chinese weakness backlashes into Europe the growth story is impugned (especially emerging markets.)

_____________________________________________________________

Video Timeline: It begins with a macro (i.e. fundamental influences) mention of quite a few of the factors noted above along with the degree to which a goodly bit of UK and Japanese data was weaker than expected last week. It also notes that Reserve Bank of Australia held the base rate steady at 2.00% this morning in spite of mining and export weakness. We now await US Vehicle Sales, ISM New York, Factory Orders and IBD/TIPP Confidence.

It moves on to S&P 500 FUTURE short-term indications at 02:45 and intermediate term view at 04:45, OTHER EQUITIES from 06:15, GOVVIES analysis beginning at 10:45 (with the BUND at 15:00) and SHORT MONEY FORWARDS 17:15. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 20:45, EUROPE at 23:15 and ASIA at 25:45, followed by the CROSS RATES at 28:00 and a return to S&P 500 FUTURE short term view at 31:30. We suggest using the timeline cursor to access the analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...