2018/02/11 Weekend: The ‘Demand-Pull’ Bond Bear

© 2018 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Weekend: Sunday, February 11, 2018

The ‘Demand-Pull’ Bond Bear

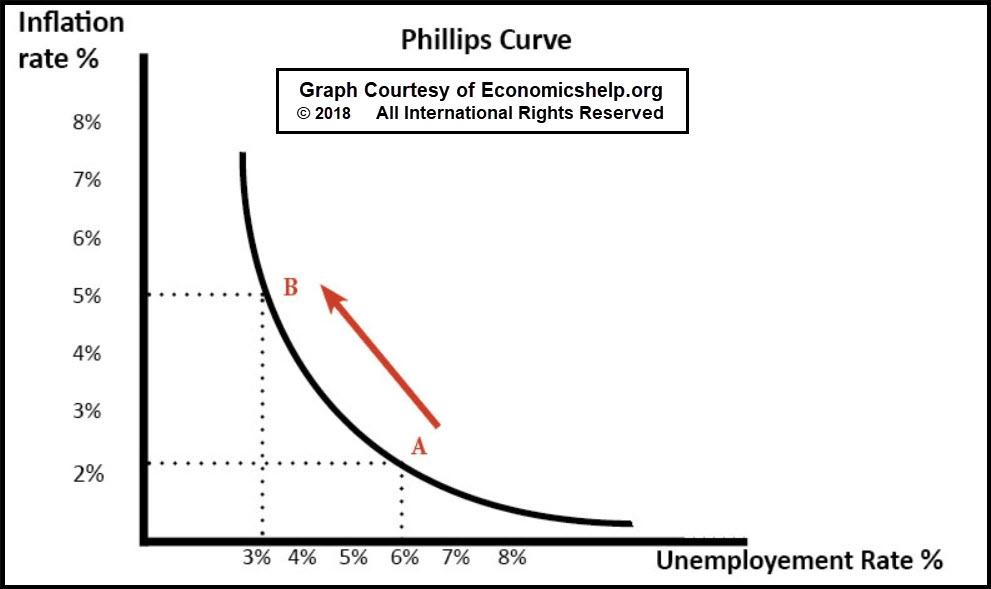

As longtime readers know, along with many other informed analysts we have been very dismissive of the Phillips Curve as a guide to resurgent inflation. On one hand, it just hasn’t performed as previously observed. Even the Fed, which has placed so much weight on further improvements in labor market conditions as the key to inflation reaching its 2.0% target, has noted that lower US unemployment has indeed not caused the classical inflation increase it (among others) had been hoping for. Yet there were good reasons for that which we have explained in previous analysis since early 2015.

As longtime readers know, along with many other informed analysts we have been very dismissive of the Phillips Curve as a guide to resurgent inflation. On one hand, it just hasn’t performed as previously observed. Even the Fed, which has placed so much weight on further improvements in labor market conditions as the key to inflation reaching its 2.0% target, has noted that lower US unemployment has indeed not caused the classical inflation increase it (among others) had been hoping for. Yet there were good reasons for that which we have explained in previous analysis since early 2015.

As recently as our February 1st Commentary: ‘Normalcy’ Unbiased? post we revisited what had been the historically depressed levels of velocity of the US Monetary Base. That was the problem with the Fed’s previous (2015 until mid-2016) ‘normalcy bias’. In its most concise expression, drags on business confidence due to the Obama administration post 2008-2009 Crisis excessive regulation created a lack of economic strength despite the Fed’s Brobdingnagian balance sheet expansion.

Yet it is apparent in headlines and individual company actions that all this is changing. (Also see the US Monetary Base Velocity graph in that February 1st post.) And if that is true, then the impact on the inflation calculus is likely changing as well. While much of this is anticipatory while inflation levels remain relatively low, the market is classically ‘a creature of expectations’. This explains quite a bit of the pressure on global government bond markets in spite of still less than rampant inflation.

Expectations of stronger corporate earnings leading to investment, hiring and rising incomes are dominating bond market psychology. That is ultimately due to the potential return of ‘demand-pull’ inflation… a phrase that has not been a part of the financial industry lexicon for over a decade. We suspect younger market participants have only heard it during their academic economic education. Yet prior to that…

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.