2015/10/013 TrendView VIDEO: Global View (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Tuesday, October 13, 2015 (early)

Still curiouser and curiouser in its way in the equities, as the response to economic influences remains an erratic yet completely understandable ‘bad news is good news’ response. However, that seems to have changed this morning on some further weak data. The question becomes whether this is the beginning of news finally weighing on equities (and boosting govvies) once again, or is this just a technical stall into the more formidable resistance equities have reached after the recent strong rally?

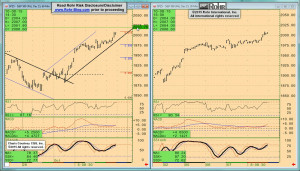

It all gets back to the ‘FOMC Friendly’ anticipation into Thursday afternoon’s release of the September 16-17 meeting minutes was continued after the actual release of those notes. And that is in spite of, or possibly because of, the clearly dovish nature of the discussion. In spite of rumors to the contrary, there was no hint that keeping rates steady was any sort of ‘close call’; the minutes are roundly dovish. That pushed the December S&P 500 future back above the 1,990 area DOWN Closing Price Reversal signal from back into and after the actual September 17th FOMC announcement and press conference. Apparently if the news is bad enough, the markets suspect there will be even more Fed accommodation.

While the govvies are holding fairly well due to the weaker economic data, the question might be why they have not been stronger on serial weakness in items like international trade data? That was weak for Australia, the US and Canada earlier this week and then Japan and Germany and the UK as well last Thursday. The answer likely lies with equities strength that creates trepidation in govvies after the weak US Employment report rally.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the weaker data being back almost across the board in addition to factors noted above. However, the addition of the OECD Composite Leading Indicators (also from last Thursday and discussed below) reinforces all the weakness in addition to the indications from the FOMC minutes. There is also the weak influence of last Friday’s Canadian Employment and US Wholesale Sales. The weakness of today’s UK CPI was offset by Chinese Trade data.

It moves on to S&P 500 FUTURE short-term indications at 02:30 and intermediate term view at 06:00, OTHER EQUITIES from 08:15, GOVVIES analysis beginning at 12:15 (with the DECEMBER BUND FUTURE at 15:30) and SHORT MONEY FORWARDS at 17:45. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 20:30, EUROPE at 22:45 and ASIA at 26:00, followed by the CROSS RATES at 28:15 and a return to S&P 500 FUTURE short term view at 31:30. We suggest using the timeline cursor to access the analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

2015/10/14 TrendView VIDEO: Concise Highlights (early)

2015/10/14 TrendView VIDEO: Concise Highlights (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Wednesday, October 14, 2015 (early)

Still curiouser and curiouser in its way in the equities, as the response to economic influences remains an erratic yet completely understandable ‘bad news is good news’ response. While that seemed to shift on Tuesday’s weak data, it is back this morning on releases after the video analysis recorded for the US Retail Sales and PPI data all coming in very weak. That also saw downward revision to last month’s bit of strength in the Retail Sales numbers. Yet, the response of the December S&P 500 future has been to hold steady near some very key near term support that is also a psychological central bank influence area. And in spite of the equities resilience, the govvies are not surprisingly bid once again, with the December Bund and Gilt futures above resistances.

It all gets back to the ‘FOMC Friendly’ anticipation into Thursday afternoon’s release of the September 16-17 meeting minutes was continued after the actual release of those notes. And that is in spite of, or possibly because of, the clearly dovish nature of the discussion. In spite of rumors to the contrary, there was no hint that keeping rates steady was any sort of ‘close call’; the minutes are roundly dovish. That pushed the December S&P 500 future back above the 1,990 area DOWN Closing Price Reversal signal from back into and after the actual September 17th FOMC announcement and press conference. Apparently if the news is bad enough, the markets suspect there will be even more Fed accommodation.

And that is why 1,990-88 area is not just a technical trend level: It is also the indication of whether the ‘bad news is good news’ psychology can continue to drive an equities rally. That is important for December S&P 500 future potential to exceed 2,015-2,020 resistance.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the weaker data being back almost across the board in addition to factors noted above. However, the addition of the OECD Composite Leading Indicators (also from last Thursday and discussed below) reinforces all the weakness in addition to the indications from the FOMC minutes. There is also the weak influence of last Friday’s Canadian Employment and US Wholesale Sales. The weakness of today’s US Retail Sales and PPI continues the run.

It moves on to S&P 500 FUTURE short-term view at 02:15 and intermediate term at 05:00 with only mention of OTHER EQUITIES from 06:30 and GOVVIES from 07:30 including discussion of the BUND at 08:00, and SHORT MONEY FORWARDS from 08:30. Foreign exchange is also only mentioned, with US DOLLAR INDEX at 08:45, Europe at 09:15, ASIA at 09:45 and CROSS RATES showing sterling’s strength against the euro at 10:45 prior to returning to the S&P 500 FUTURE short term view at 11:00.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...