2015/10/22 Commentary: Draghi drives disinflation psych (late)

© 2015 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY (Non-Video): Thursday, October 22, 2015

Commentary: ECB press conference

It is probably not much of a surprise that Mario Draghi was very pointed on the continued risks of disinflation (as opposed to outright deflation.) He had some help from others at this particular meeting in Malta (more below), and even went beyond what some might have expected. While that did not include any commitment to an expanded ECB Quantitative Easing (QE) program at this meeting, he left little doubt that it was a possibility based on how economic circumstances evolve. Yet there was little doubt regarding the impact on the markets.

It is probably not much of a surprise that Mario Draghi was very pointed on the continued risks of disinflation (as opposed to outright deflation.) He had some help from others at this particular meeting in Malta (more below), and even went beyond what some might have expected. While that did not include any commitment to an expanded ECB Quantitative Easing (QE) program at this meeting, he left little doubt that it was a possibility based on how economic circumstances evolve. Yet there was little doubt regarding the impact on the markets.

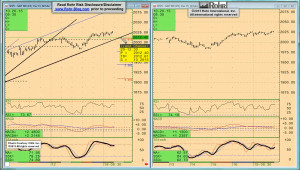

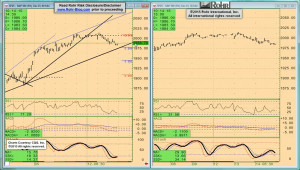

Whatever might have been vexing the US equities late Wednesday, it was a clear example of “The Agony and the Ecstasy” (with apologies to Irving Stone for coopting the name of his book once again) as Wednesday’s weakness retesting 2,015-10 support turned into a $15 higher December S&P 500 future gap opening that led to trading up to $24 higher by the end of the first half hour. In the context of continued major central bank accommodation, the ‘bad news is good news’ psychology is still driving the equities rally on what has been miserable economic data and even weak corporate earnings without inflicting any pain on the govvies. After all, for the latter ‘bad’ news is usually ‘good’ news. The euro weakening as well was a sideshow in a ranging Foreign exchange market.

In any event, the concise topical review of the full ECB press conference is explored below. For anyone who is interested, you can also review the full video of the press conference and the transcripts of the opening statement and Q&A. While there was no real ‘news’ today, the extensive review and renewed commitment to all of the monetary tools the ECB has at its disposal and is eminently ready to use was impressive; possibly even more so than the previous focus on the incremental initiation of each of these methods.

It was a tour de force of a central bank still focused on “whatever is necessary.”

[For anyone who missed the earlier notification, there was an update of the current Market Observations prior to the ECB press conference added to Wednesday morning’s Global View TrendView post. Those current market comments are still the relevant view, and can be found below the video for all Gold and Platinum echelon subscribers.]

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options and join us. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the extended trend assessment as well.

2015/10/21 TrendView VIDEO: Global View (early)

2015/10/21 TrendView VIDEO: Global View (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Wednesday, October 21, 2015 (early)

As noted previous, while this is still curious, it is also not so curious at all on continued equities responses to both weak and upbeat recent economic data. That continues to encourage an erratic yet understandable ‘bad news is good news’ rally, with bouts of perverse weakness on better data at times. The response to this morning’s weak Asian economic data (including Japan’s Trade figures showing export implosion) is for the equities to rally. And this is likely on a transition from ‘FOMC Friendly’ influence into an ‘ECB Friendly’ influence on the way into Thursday morning’s Rate decision and press conference.

Even with last Wednesday’s very weak Walmart corporate earnings and guidance, even further weak economic data Thursday morning encouraged the December S&P 500 future to gap back above the key 1,990-88 area. And on the mid-morning Thursday pullback it only got right to the top of that 1,990-88 range prior to putting on an orderly yet extensive rally to critical resistance. It all gets back to the ‘FOMC Friendly’ anticipation into release of the September 16-17 meeting minutes that continued after their release. And that is in spite of, or possibly because of, the clearly dovish nature of the discussion. Basically the December contract Negated (i.e. overran) the daily DOWN CPR (Closing Price Reversal) from back on that September 17th FOMC announcement and press conference. This was more definitive evidence of the ‘bad news is good news’ psychology. Ultimately that set the stage for also overrunning key resistances at the 2,011, 2,015 and 2,020 levels that now leaves it up near the major 2,035-40 March-July congestion resistance.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the weaker data being back almost across the board in addition to factors noted above. However, the addition of OECD Composite Leading Indicators (also discussed last Thursday and in previous posts) reinforces all the weakness in addition to the indications from the FOMC. While there is also the weak influence of global Trade figures, of late some of the data is improving a bit. That includes Michigan Confidence last Friday, Monday’s Chinese data and Tuesday’s US Housing Starts. Yet Japan and Australia data this morning were weak.

It moves on to S&P 500 FUTURE short-term indications at 02:30 and intermediate term view at 05:45, OTHER EQUITIES from 07:15, GOVVIES analysis beginning at 10:15 (with the DECEMBER BUND FUTURE at 12:15) yet only mention of the stable SHORT MONEY FORWARDS at 13:15. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 14:45, EUROPE at 15:30 and ASIA at 17:30, followed by the CROSS RATES at 19:30 and a return to S&P 500 FUTURE short term view at 22:30. We suggest using the timeline cursor to access the analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...