2015/11/02 TrendView VIDEO: Global View (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Monday, November 2, 2015 (early)

The FOMC ‘halo’ effect on equities that typically lasts 1-3 days after an accommodative statement seemed to wear off late last Friday. While last Wednesday’s missive tried to sound more hawkish for that first hike in almost a decade still being possible into the end of this year, there were still a lot of ‘data dependent’ caveats in the statement. Specific mention of consideration of ‘whether’ to “…raise the target rate at its next meeting…” sounded fairly hawkish compared to open ended language in previous FOMC statements. Yet this seems more so confirming their desire to put through the rate increase before the end of 2015. And closer scrutiny of the FOMC statement (that links to our marked up version) shows they are still waiting to see how quite a few factors develop.

That is currently not nearly as focused on the global situation in the ‘monitoring’ language compared to the last statement specifically noting concerns there. Yet the fact is that the global situation is indeed troubling right now, and that was reinforced by the latest OECD Composite Leading Indicators earlier last month; which is something we have highlighted for many months. This also plays into all of the serial weak global economic data that now includes much of the US data as well of late.

And this gets back to the sort of influence which belies the ostensibly hawkish aspects of the FOMC statement with their continued concerns over “…some further improvement in the labor market…” after the earlier observation that… “The pace of job gains has slowed…” This is further Fed-speak double-talk for the degree to which they remain ‘data dependent’ in spite of no longer wanting to use that language. That is also why this week’s US Employment report and other data this month takes on additional importance. As the first data of the fourth quarter, it will signal whether there is any rebound after a weak Q3.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the central bank factors noted above. However, the addition of OECD Composite Leading Indicators reinforces all the economic weakness seen last week again. While there is also the weak influence of global Trade figures, further weakness in US Manufacturing PMI this morning along with China is not the sort of thing that will encourage Fed confidence for a rate hike.

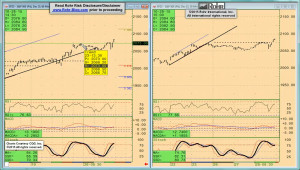

It moves on to S&P 500 FUTURE short-term at 03:00 and intermediate term view at 05:00, OTHER EQUITIES from 07:45, GOVVIES analysis beginning at 10:45 (with the DECEMBER BUND FUTURE at 14:15) and skipping stagnant SHORT MONEY FORWARDS. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 16:00, EUROPE at 18:15 and ASIA at 21:15, followed by the CROSS RATES at 24:00 and a return to S&P 500 FUTURE short term view at 28:00. We suggest using the timeline cursor to access analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

2015/11/04 TrendView VIDEO: Global View (early)

2015/11/04 TrendView VIDEO: Global View (early)

© 2015 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Wednesday, November 4, 2015 (early)

While the 1-3 day FOMC ‘halo’ effect on equities seemed to wear off late last Friday, the gap higher Monday morning still kept the short term trend up. And that was reinforced by the December S&P 500 future pushing above interim 2,100 resistance, yet with more major resistances into 2,114.20 (December contract high from back in July), 2,120 failed May UP Break and the 2,132 all-time lead contract high. Why is it so important to note these in the initial background discussion? Because right now the US equities are an outlier as the other equities still struggle at much lower levels compared to their previous highs.

And this is interesting due to the return to an ostensibly more hawkish stance by the Fed in last week’s FOMC statement. While it still seems significantly ‘data dependent’, the FOMC mention of ‘whether’ to “…raise the target rate at its next meeting…” sounded fairly hawkish against open ended language in previous FOMC statements. Closer scrutiny of the FOMC statement (that links to our marked up version) shows they are still waiting to see how quite a few factors develop.

So while Janet Yellen’s House Financial Services Committee testimony today is supposed to be on supervision and regulation, any indications spilling over into monetary policy may have an impact on the markets. And the fact that you have a bunch of politicians as inquisitors, do we really believe they will be able to resist commenting and question the Fed’s rate intentions? Especially with data improving to some degree (this week’s global PMI’s have been positive on balance), the Fed will likely continue to sound hawkish.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the central bank factors noted above along with the ECB influence. After review of those global PMI indications it notes that there are even more important factors than Ms. Yellen’s testimony today pending later this week. In addition to other important data there is Thursday’s BoE rate decision and Inflation Report press conference, with the entire week culminating in Friday’s US and Canadian Employment reports. And all of this is now Q4 data as well.

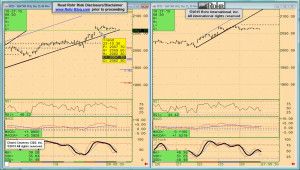

It moves on to S&P 500 FUTURE short-term at 02:30 and intermediate term view at 05:30, OTHER EQUITIES from 08:45, GOVVIES analysis beginning at 12:45 (with the DECEMBER BUND FUTURE at 16:00) and SHORT MONEY FORWARDS discussion from 17:45. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 20:15, EUROPE at 22:00 and ASIA at 25:30, followed by the CROSS RATES at 28:15 and a return to S&P 500 FUTURE short term view at 32:00. We suggest using the timeline cursor to access analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...