2018/03/20 Commentary: Trump Tribulation

© 2018 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Commentary: Tuesday, March 20, 2018

Trump Tribulation

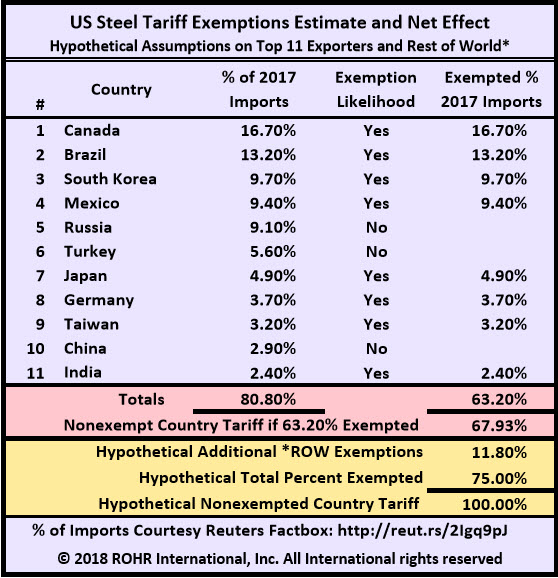

There is one problem with the possible meeting of the minds on trade tariffs at the G20 meeting: it didn’t happen! While there might be further news later this week, for now the situation seems to be that Messrs. Mnuchin and Ross are sticking with the US ‘looking out for its own economic interests’ party line. That leaves the EU in particular (which does not have the temporary steel and aluminum tariffs exemptions enjoyed by Canada and Mexico) ready, willing and able to impose retaliatory tariffs. Regardless of the potential economic and market implications, the political context means that European leaders cannot just let the US impose sanctions on their industries (and workers) and NOT respond. The likelihood of a response from countries affected by the pending US tariffs has been played down by some in the Trump administration. This is folly. Commerce Secretary Ross is an experienced businessman who should know better. Yet there is a problem with another Trump advisor.

There is one problem with the possible meeting of the minds on trade tariffs at the G20 meeting: it didn’t happen! While there might be further news later this week, for now the situation seems to be that Messrs. Mnuchin and Ross are sticking with the US ‘looking out for its own economic interests’ party line. That leaves the EU in particular (which does not have the temporary steel and aluminum tariffs exemptions enjoyed by Canada and Mexico) ready, willing and able to impose retaliatory tariffs. Regardless of the potential economic and market implications, the political context means that European leaders cannot just let the US impose sanctions on their industries (and workers) and NOT respond. The likelihood of a response from countries affected by the pending US tariffs has been played down by some in the Trump administration. This is folly. Commerce Secretary Ross is an experienced businessman who should know better. Yet there is a problem with another Trump advisor.

And as we have noted since shortly after the March 1st tariffs announcement, it seems Professor Navarro is an over-educated fool. Right after the original steel and aluminum tariffs announcement Navarro appeared on Sunday news shows, expressing confidence other countries would not retaliate… because the US has such a large economy(??). What in the world does that have to do with likely retaliation of trading partners?

It demonstrates a breathtaking lack of understanding of realpolitik. Based on what we have seen in the wake of the G20 not resolving the US push for those steel and aluminum tariffs, things might get fairly dicey again after a period of upbeat calm into Wednesday’s FOMC rate hike, projection revisions and press conference. We shall see. Yet there is more to bother the equities and US dollar and potentially bolster the govvies in the recent activity within the Trump administration beyond the very prominent tariffs issue.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.