2016/01/15 TrendView VIDEO: Concise Highlights (early)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Friday, January 15, 2016 (early)

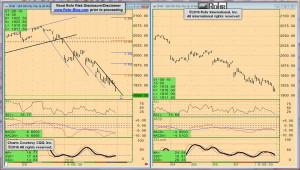

A wild finish to a wild week… well, actually two weeks. Yet this is not a huge surprise after the very weak start to 2016 last week. And rather than becoming more subdued after a sizable correction, the US equities and other markets are entering an even more critical phase into the long US Martin Luther King Day holiday weekend closure Monday. This is going to intensify today’s end of week decision right as the March S&P 500 future plops back down near the next critical major support after Thursday’s sharp recovery.

To cut right to the key market activity after yesterday’s Meltdown Time? Redux post revisited the negative economic background, March S&P 500 future starting the year gapping below the major 2,020-10 range was already a very negative sign.

Then last week Thursday morning’s gap below the far more critical (late 2014 into early February 2015) lower 1,975-70 congestion and failure to recover back above that area on the early bounce left it very weak. That was due to each of the previous slides below that area (both in August and September) saw further weakness below interim supports in the 1,960 and 1,930 areas. That indicated a selloff into (and in some cases well below) the 1,900 area was likely. And that is just what transpired. However, there is one more technical threshold that will likely indicate whether or not the equities are in a complete meltdown, or can possibly at least stabilize for an upside reaction. That is the lower major 1,865-60 support. The importance of that area is reviewed in the video from 07:00. For any of you who have not reviewed that in the previous video analysis, we suggest a look.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the return to weaker data overall that was very apparent in the Bank of England holding the base rate steady at the 0.50% all-time low on Thursday and also indicating it was not interested in following the Fed’s rate hike lead. That was reinforced by Friday morning’s weak UK Construction Output and Chinese New Yuan Loans, even if overall Chinese lending levels were up, as was the Australian loan picture as we head into a lot of US data today.

It moves on to S&P 500 FUTURE short-term view at 02:00 and intermediate term at 05:30 with a view of the very long term trend on the monthly chart at 07:00, and then only mention of OTHER EQUITIES from 09:00 and GOVVIES from 10:00 including the BUND at 10:45, and only mention of SHORT MONEY FORWARDS from 11:15. Foreign exchange is also only mentioned, with US DOLLAR INDEX at 11:45, Europe at 12:00, ASIA at 12:45 and CROSS RATES active on the weakness of the pound and Australian dollar at 13:45 prior to returning to the S&P 500 FUTURE short term view at 15:00.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

2016/01/15 TrendView VIDEO: Foreign Exchange (weekend)

2016/01/15 TrendView VIDEO: Foreign Exchange (weekend)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Friday, January 15, 2016 (weekend)

While not quite as wild and wooly as the equities, foreign exchange has had its aggressive movements in select individual currencies. In fact, in terms of breaking various historic technical thresholds, some of the foreign exchange movement has been as impressive as the global stock markets (even if quite a bit less volatile.) Of course, some of the drivers for the more extensive price adjustments in the foreign exchange market are very much the same as the influences weighing on the equities of late. Obviously those include the weakness of energy and commodity prices. Most of the conversation of late has been about the weakness in Crude Oil due to the particular risks associated with its decline.

Much less topical yet no less indicative of the global economic and manufacturing weakness is the extended selloff in Copper. While so many analysts are enthusiastic about the recovery in US home building, little attention has been paid to this serial price decline that speaks of a much weaker conditions for the global housing industry and manufacturing sector. It is not yet anywhere near its 1.2500 December 2008 low while Crude Oil knocks out its equivalent 32.40 low. Yet front month Copper futures dropping back below 2.0000 have violated quite a bit of psychological and technical support from back up in the 2.1500 range and below. Why all of this focus on an industrial metal and energy market trends in the discussion of foreign exchange?

Simple. Even beyond the energy prices impact on the oil exporters, industrial metals are an important component of many of the global economies. As such, reduced receipts for commodities exports are very significant influence on their economic fortunes, and a direct influence on the perceived value of their currencies. No secrets here that the accelerated selloffs in both energy and industrial metals in late 2014 that re-accelerated out of last summer are significant influences. Simply take a look at the commensurate trends in the Australian and Canadian dollars, and the emerging market currencies.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the return to weaker data overall that was very apparent in the Bank of England holding the base rate steady at the 0.50% all-time low Thursday and the Fed’s Bullard raising issues about the path of inflation that relates to the discussion above. However, as we discussed the more extensive macro influences in the complementary Global View: Equities & Fixed Income TrendView video analysis post from this weekend, we refer you to that for further details.

It moves on to the US DOLLAR INDEX at 01:30, EUROPE at 04:00 and ASIA at 07:30, followed by the very active CROSS RATES at 09:15 to complete the full review.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...