2016/03/23 Commentary: FOMC ‘Normalcy Bias’ Crumbles

© 2016 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY (Non-Video): Wednesday, March 23, 2016 (late)

FOMC ‘Normalcy Bias’ Crumbles

The Fed has no Cred!! The Federal Reserve’s credibility is reaching new lows with most of the US and global financial community in the wake of recent significant shifts in policy and communication. More on that below, but first a reminder of something we first noted back in our November 22, 2013 Commentary: It’s the Fed PR, stupid:

The Fed has no Cred!! The Federal Reserve’s credibility is reaching new lows with most of the US and global financial community in the wake of recent significant shifts in policy and communication. More on that below, but first a reminder of something we first noted back in our November 22, 2013 Commentary: It’s the Fed PR, stupid:

“Over the past 30 years central bankers have gone from inscrutable to insufferable.”

At the time there was a lot of divisive discussion of when and how the Fed’s famous Quantitative Easing (QE) taper would take place. Yet more than two years later it is not only no different on the extremes that are being reached on the potential for further FOMC rate hikes, in its way it is far worse. First there was the Fed’s ‘normalcy bias’ that left it far too hawkish after the first rate hike in almost a decade back on December 16th (see our post that day for more.) That led to last week’s major volte face on the likelihood of only two rate hikes in 2016 instead of the four that it had signaled prior to then.

Yet this week there were countervailing hawkish opinions, and even a flip-flop by one of the typically hawkish Fed minions who had been more dovish of late. The former was the new Philadelphia Fed President Patrick Harker, and the latter was New York Fed President William Dudley. We suppose that Mr. Harker should have been expected to carry on the traditionally hawkish view of previous Philadelphia Fed President Charles Plosser. But Mr. Dudley had only recently been one of the main proponents of more gradual rate increases in the context of global economic weakness. That’s a real flip-flop.

And both of them are now saying the April FOMC meeting is ‘live’ as a potential rate hike horizon. We suppose if one now believes Mr. Harker is right that not two but three hikes are still likely this year, the April meeting would need to be ‘live’. Yet this all creates more confusion on not just the most likely action by the Fed, but also whether it actually has any idea what it is doing? That is not just on policy, but also on perception it is the ‘steady hand on the economic tiller’ that it always claims is part of its benefit to the economy and society at large. These rapid fluctuations that are reflected in immediate ‘risk-on’ and ‘risk-off’ market reactions can’t be good for mainstream business investment confidence. After all these years of the Greenspan and then accelerated Bernanke ‘transparency’ drives, how much more do we know now than when the central banks were opaque?

While we review quite a bit else, the comparison between 2016 and 2007 when Fed action also could not save the world is near the end. And we remind everyone:

The next financial crisis will occur when the investment and portfolio management community (and ultimately the investing public) realizes that the central banks alone cannot restore the robust growth from prior to the 2008-2009 financial crisis.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

2016/03/22 TrendView VIDEO: Global View (early)

2016/03/22 TrendView VIDEO: Global View (early)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Tuesday, March 22, 2016

First of all, our sympathy and support for the people and families of those who were killed or wounded in the terror attacks this morning in Brussels. Attacking innocents is never an acceptable form of political expression. However, as we noted after last November’s Paris terror events, “Let’s allow once again that this was a horrific human tragedy.” “Yet, in the intermediate term human tragedies do not tend to be equity market tragedies as well.” “As with natural disasters like floods, earthquakes and hurricanes, there is an assumption that the rebuilding process will require expenditures that will support the economy.”

That might seem a bit insensitive right now. Yet the markets are clearly already reflecting that reality. Even the DAX, the most closely related market we cover to this morning’s horrible events, only traded down less than 100 points this morning. It has now recovered to only slightly lower on the day. The govvies did not attract much of a ‘haven’ bid at all. And what there was has already dissipated in a June Bund future that is back from half a point higher to steady on the day. Similarly, there is almost no ‘haven’ bid in the US Dollar Index that is often the anticipated beneficiary of problems elsewhere in the world.

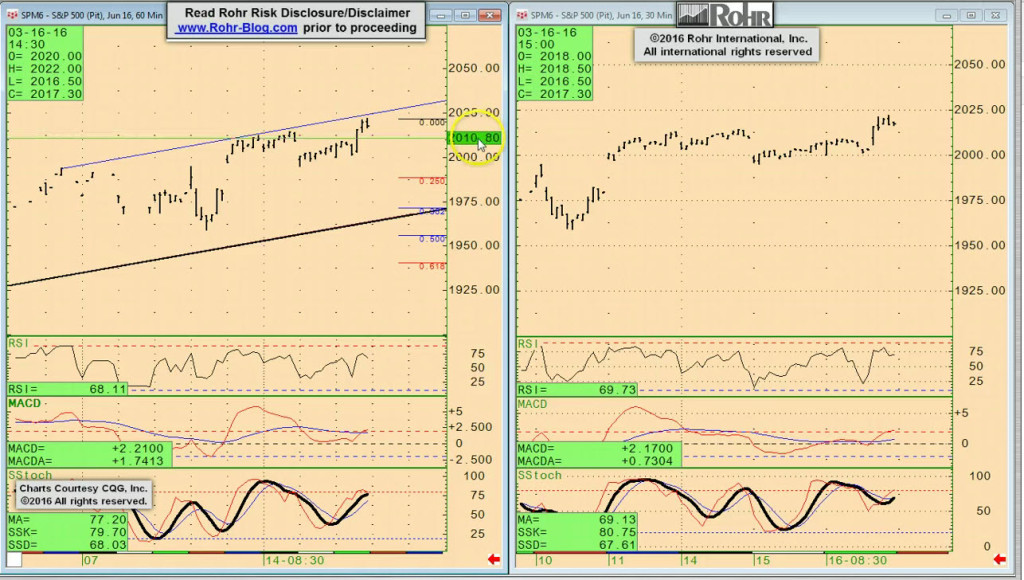

And to complete this initial review of markets we felt important under the circumstances, the June S&P 500 future has been the upside leader attempting to assist the far more challenged European equities. As it was at a much higher relative level than its European counterparts, it might have been vulnerable to more of a selloff. Yet there is also renewed ‘bad news is good news’ psychology at work since last Wednesday’s more dovish FOMC pronouncements. As such, it is not much of a surprise that it has only dipped back to the 2,035 interim technical area it had quietly pushed above in the past couple of sessions. And even if it should dip a bit further, the more major support remains 2,020-10.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) just how weak the data remains on balance, especially Euro-zone Advance Manufacturing PMI’s this morning. And that is along with German ZEW among other weak signs in Asia and the US as well.

It moves on to S&P 500 FUTURE short-term at 02:30 and intermediate term view at 05:30, with OTHER equities from 07:30, GOVVIES beginning at 11:00 (with the BUND FUTURE at 14:00 including implications of last Tuesday’s expiration rollover) and SHORT MONEY FORWARDS from 15:15. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 18:30 EUROPE at 20:30 and ASIA at 23:00, followed by the CROSS RATES at 25:15 and a return to S&P 500 FUTURE short term view at 29:15. We suggest using the timeline cursor to access the analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...