2016/03/30 TrendView VIDEO: Concise Highlights (early)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Wednesday, March 30, 2016

Janet Yellen’s Tuesday speech put a generally dovish end to the reversals by the Fed’s more hawkish minions since the FOMC meeting two weeks ago indicated there was a more dovish view. Basically the ‘Big Dog’ told the mutts yelping about how rates should still be headed higher sooner than not that they should stand down. This was not just rank-pulling, as Chair Yellen was very articulate on the economic reasons for not getting too aggressive about signaling future rate hikes. For one thing, this is how the Fed managed to talk itself into its less than useful ‘normalcy bias’ into the December meeting. For another, it would have been better back then to remain more ‘data dependent’, as it seems to have reverted to at present.

Last but not least, most amazingly, in that regard she suggested total flexibility on the potential for the next moves in Federal Funds to be down instead of up if the economic data warranted, and even opened the door to the possibility that Fed Quantitative Easing could be resumed if necessary!! That is consistent with our (and quite a few other folks) previous views that the December FOMC rate hike was merely the full extension of the Fed’s ‘normalcy bias’. She has now constructively left any of the Fed minions who would presume to tell the economy what it is doing instead of listening for the real message from the economy looking pretty foolish. Good for her. The key passages reinforcing her views on this can be accessed in our mildly marked-up version of her speech. We especially suggest the “Risks to the Inflation Outlook” section on page 10, and the “Monetary Policy Implications” paragraph from the bottom of page 12.

The bottom line is as noted in last Wednesday’s FOMC Normalcy Bias Crumbles.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) mention of the degree to which the central banks have been the primary influence over the past two weeks, and that keeps the equities psychology upbeat in spite of some weak data at times. We saw more of that in weaker than expected US Durable Goods last Thursday and GDP Friday among other data this week like weak US Personal Spending and Japanese figures.

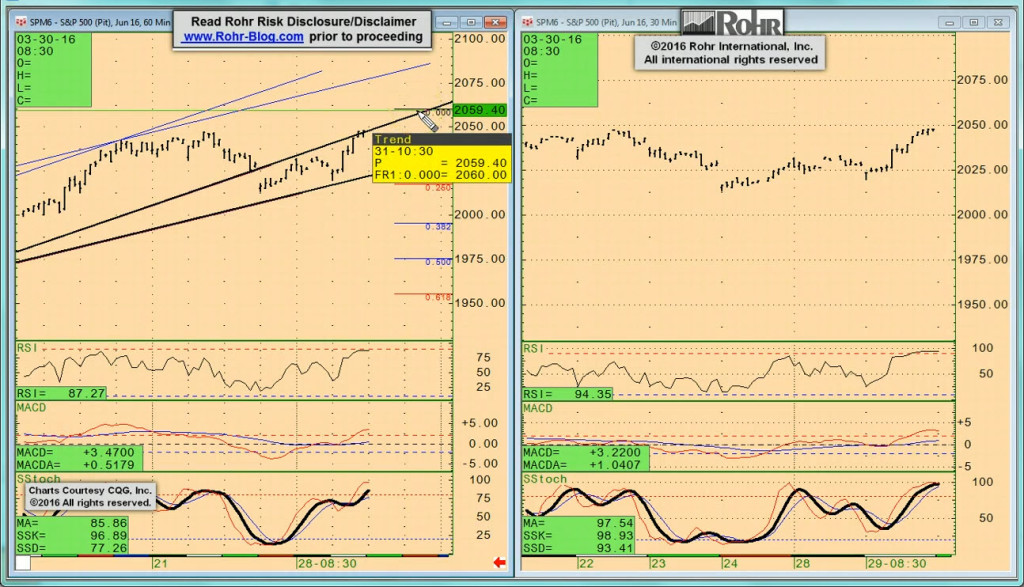

It moves on to S&P 500 FUTURE short-term view at 02:30 and intermediate term at 06:45, and then only mention of OTHER EQUITIES from 09:45 and GOVVIES from 11:30 including the BUND at 12:30 and SHORT MONEY FORWARDS from 14:00. Foreign exchange also only mentions the US DOLLAR INDEX at 14:30, Europe at 15:30 and ASIA at 17:15, with only mention of CROSS RATES remaining steady yet with the euro keeping its recent bid at 18:45 prior to returning to the S&P 500 FUTURE short term view at 19:15.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

2016/03/31 TrendView VIDEO: Global View (early)

2016/03/31 TrendView VIDEO: Global View (early)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Thursday, March 31, 2016

As noted in Wednesday’s Concise Highlights post, Janet Yellen’s Tuesday speech put a generally dovish end to reversals by the Fed’s more hawkish minions since the FOMC meeting two weeks ago indicated there was a more dovish view. Basically the ‘Big Dog’ told the mutts yelping about how rates should still be headed higher sooner than not that they should stand down. This was not just rank-pulling, as Chair Yellen was very articulate on the economic reasons for not getting too aggressive about signaling future rate hikes. For one thing, this is how the Fed managed to talk itself into its less than useful ‘normalcy bias’ into the December meeting. For another, it would have been better back then to remain more ‘data dependent’, as it seems to have reverted to at present.

Last but not least, most amazingly, in that regard she suggested total flexibility on the potential for the next moves in Federal Funds to be down instead of up if the economic data warranted, and even opened the door to the possibility that Fed Quantitative Easing could be resumed if necessary!! That is consistent with our (and quite a few other folks) previous views that the December FOMC rate hike was merely the full extension of the Fed’s ‘normalcy bias’. She has now constructively left any of the Fed minions who would presume to tell the economy what it is doing instead of listening for the real message from the economy looking pretty foolish. Good for her. The key passages reinforcing her views on this can be accessed in our mildly marked-up version of her speech. We especially suggest the “Risks to the Inflation Outlook” section on page 10, and the “Monetary Policy Implications” paragraph from the bottom of page 12. [Also see the interesting video panel discussion near the end of this opening section.]

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) discussion on the economic data turning just a bit stronger today. That included Japan Housing Starts, Australian credit figures, annualized German Retail Sales, UK GDP and Chicago PMI. Along with that the more dovish Fed reinstates the ‘Goldilocks’ equities psychology.

It moves on to S&P 500 FUTURE short-term at 02:30 and intermediate term view at 04:45, with OTHER equities from 06:30, GOVVIES beginning at 09:15 (with the BUND FUTURE at 11:30 including implications of the early month expiration rollover) and SHORT MONEY FORWARDS from 13:15. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 16:00 EUROPE at 17:30 and ASIA at 19:45, followed by the CROSS RATES at 22:00 and a return to S&P 500 FUTURE short term view at 25:00. We suggest using the timeline cursor to access the analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion.

Read more...