2016/0/04 Commentary: Special Alert: Equities Critical (early)

© 2016 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY (Non-Video): Thursday, April 28, 2016

Special Alert: Equities Critical

Special Alert: Equities Critical

The next financial crisis will occur when the investment and portfolio management community (and ultimately the investing public) realizes that the central banks alone cannot restore the robust growth from prior to the 2008-2009 financial crisis.

That has been a consistently repeated focal point for every one of our analyses since we first published the underlined form of it in our February 9th Fear & Loathing in Marketland post. As our longtime readers know, this was all only a natural extension of our long held view on the political class’ failure to deliver structural reform. That was necessary to reinforce and enhance the cyclical gains encouraged by the many forms of very extensive central bank accommodation.

For all of the short-term success of the central banks extremely low interest rate and Quantitative Easing (QE) efforts, they were not likely to provide a return to real growth without structural reforms. There is a brief summary of our long term key views on that below. For now suffice to say that in our March 23rd Fed’s ‘Normalcy Bias’ Crumbles post (PDF version available via the sidebar) we specifically noted in the Limits of Central Bank Powers section (page 4) “Negative rates are the end of the (very distended) line.”

Evidently the Bank of Japan is feeling that in its lack of ability to provide what was somewhat broadly expected expanded QE and a move farther into negative interest rates today. Once it did not happen the global equities came under pressure. Yet even if they had moved it was problematic how much the equities would have benefited from further central bank accommodation that had not produced any meaningful swing back into robust growth that many had (misguidedly) hoped would occur. In fact, shortly prior to the BoJ decision to hold steady the latest inflation figures showed worse than expected Japanese CPI, which leaves them back in deflation after decades of various QE efforts. The lack of efficacy of central bank QE to foment a return to robust growth on its own is also apparent in the recent serial weak global data foretold by various NGO projections.

[NOTE: We are providing this brief Special Alert in lieu of a full TrendView Global View video analysis this morning in order to provide more accessible analysis in the context of the major equities market weakness and other asset class moves. We will be developing a full Global View video analysis once the dust has settled after today’s US Close.]

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options and join us. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the extended trend assessment as well.

Read more...

2016/04/29 TrendView VIDEO: Global View (early)

2016/04/29 TrendView VIDEO: Global View (early)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Friday, April 29, 2016 (early)

Anyone who has not already read Thursday morning’s Special Alert: Equities Critical should do so right away.

It looks like the influence of the ‘Yellen Put’ is finally waning in the face of serial weak economic data. In spite of FOMC sounding fairly accommodative Wednesday afternoon, there was not much upside progress in the US equities. Some thought the lack of more instances of the word ‘global’ meant it was less dovish. This is silly, and you can read our mildly marked up version for yourself. After last week Thursday’s June S&P 500 future selloff from 2,103-10 after a still accommodative ECB press conference, there seems to be even more ineffective central bank influence with the BoJ’s refusal to dive deeper into NIRP (Negative Interest Rate Policy) this Thursday morning. As we very pointedly noted in our March 23rd Fed’s ‘Normalcy Bias’ Crumbles post (PDF version available via the sidebar) the Limits of Central Bank Powers section (page 4), “Negative rates are the end of the (very distended) line.”

What we are now seeing is the denouement of the extended multi-year central bank efforts to rescue economies that climaxed in the recent US equities rally. Yet that was without the essential assistance of structural reforms from the political class. As emphasized ever since our February 9th Fear & Loathing in Marketland post:

The next financial crisis will occur when the investment and portfolio management community (and ultimately the investing public) realizes that the central banks alone cannot restore the robust growth from prior to the 2008-2009 financial crisis.

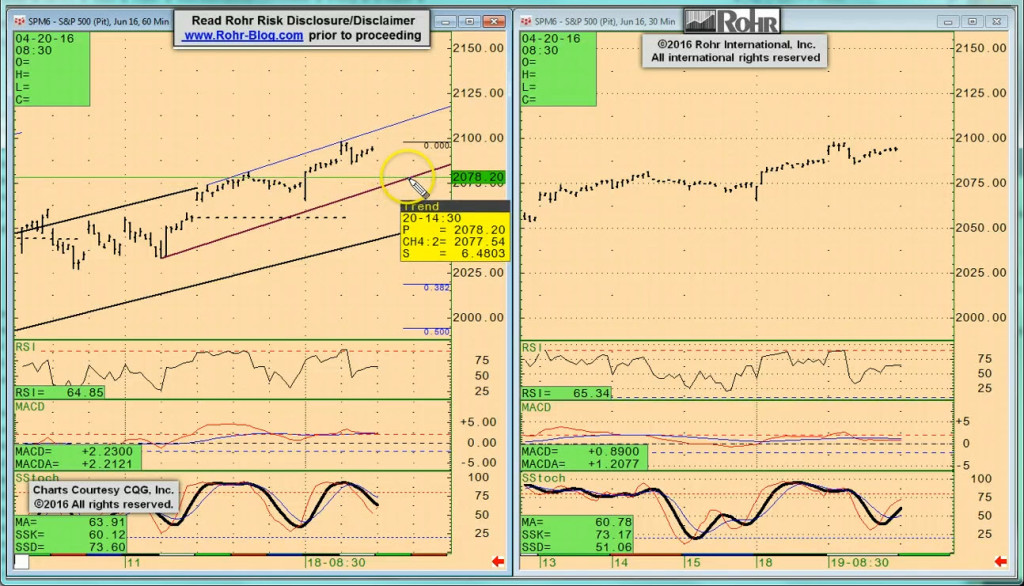

We will reserve the more definitive US equities trend dynamics discussion for the section below. Yet what we know for certain is after more than a week since what was supposed to be a June S&P 500 future 2,078 significant UP Break out of its major weekly down channel (from the May 2015 high) it appears to be failing. _____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) discussion of just how negative the serial weak data has been in spite of years of central bank QE and very low interest rates. That is followed by definitive analysis of the short- and intermediate-term June S&P 500 future Evolutionary Trend View (ETV) that points out the hypercritical nature of the lower 2,060-2,055 daily chart gap extended Tolerance of the 2,078 UP Break.

It moves on to S&P 500 FUTURE short-term at 04:45 and intermediate term view at 08:15, with OTHER equities from 10:30, GOVVIES beginning at 13:15 (with the BUND FUTURE at 16:00 including implications of the early March expiration rollover) and SHORT MONEY FORWARDS from 18:15. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 21:00 EUROPE at 24:00 and ASIA at 26:45, followed by the CROSS RATES at 30:15 and a return to S&P 500 FUTURE short term view at 33:15. As this a longer than usual video analysis, we suggest using the timeline cursor to access the analysis most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Read more...