2016/05/15 TrendView VIDEO: Special 3 - Weekend

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Weekend, May 15, 2016 (weekend)

This Special 3 - Weekend edition of the TrendView video analysis is purposely to update the only three situations which seemed more important than any other markets after Friday’s US Close rang down the curtain on last week’s very important macro-technical developments. On the ‘macro’ front the economic data has remained very mixed, even within individual countries. Note last Monday’s very strong German Factory Orders followed by Tuesday’s very weak Industrial Production. UK data remained weak, and even the positive Chinese and German Trade Balances were in the context of very weak Import data. And historically that has been indicative of a weakening global economy. Also reinforcing that was last Wednesday morning’s OECD Composite Leading Indicators (CLI.) They have been a very useful forward indication for the weakening global economy out of last year in early this year.

They are showing some strengthening from the previous abysmal forward indications for the emerging market economies. Yet their less than optimistic outlook for much of the developed world continues to reinforce our bearish instincts, as you can see in our mildly marked-up version. Especially the weakness of the US, UK and Germany, with stallouts now seeming to start in some of the previously more upbeat European economies, remains negative. The stubbornly upbeat psychology of the monthly report editors shows up once again in a typical ‘rose-colored glasses’ headline trumpeting “Stable growth…” Especially take a look at the highlighted data in the statistical table on page 3 and draw your own conclusions.

The point of all this overall negative background is how it relates to the US equities and govvies response to what was very strong US data on Friday. Everything from the very important strong rebound in Retail Sales to upbeat Business Inventories and especially the ‘over the top’ Preliminary Michigan Confidence (95.8 versus an 89.50 estimate) all should have reinforced the notion there might be a US Q2 rebound from a weak Q1. Counterintuitively the equities dropped to a new low for the week and a one month low weekly Close, and the govvies strengthened right into that strong data.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) discussion of how the ineffectiveness of central bank QE and very low interest rates remain a real problem along with how the strong US economic did not bring the anticipated response on Friday.

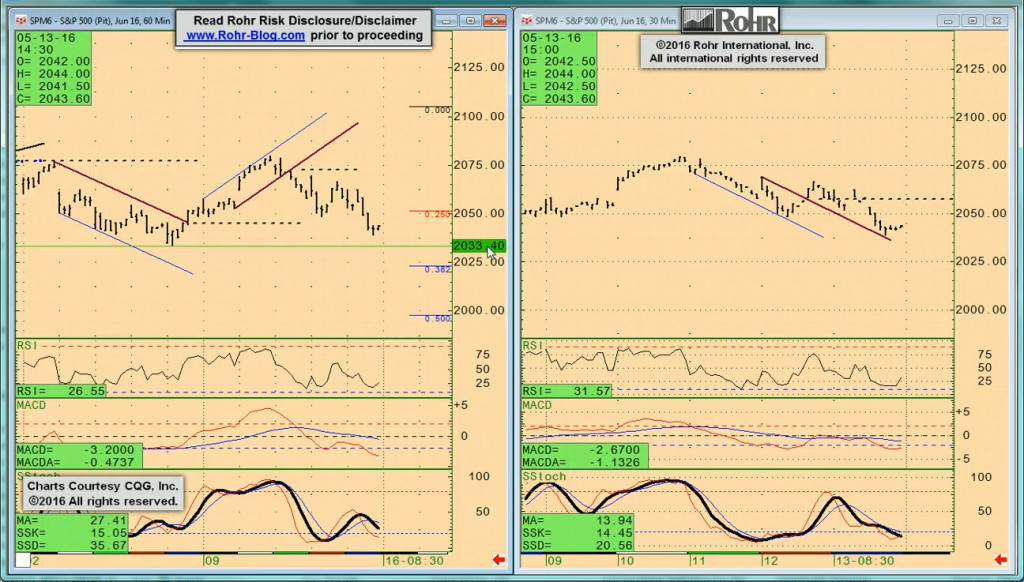

It moves on to S&P 500 FUTURE short-term at 04:30 and intermediate term at 07:45, the GOVVIES (mostly on the T-note future) at 11:45 (with a brief look at the Bund at 16:15), and the FOREIGN EXCHANGE beginning with the US DOLLAR INDEX at 17:30, EUR/USD at 20:45, AUD/USD at 22:30 and USD/JPY at 24:00, returning to S&P 500 FUTURE at 25:30.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Read more...

2016/05/18 TrendView VIDEO: Global View (early)

2016/05/18 TrendView VIDEO: Global View (early)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Wednesday, May 18, 2016 (early)

As the central banks have obviously hit the end of the (very distended) line on effective influence of NIRP (Negative Interest Rate Policy) or further Quantitative Easing (QE), the focus now revolves around to the Fed. Is it indeed now inclined to hike sooner than not if the US economic data remains strong? That is obvious from the weaker US equities activity last Friday into Tuesday on what can only be described as very strong US data across many areas. All of this will come into sharp focus on the April 26-27 FOMC Meeting Minutes release at 13:00 CDT this afternoon. This is more important than usual due to the other interpretation of the US equities weakness. That sees the current stronger US economic data in the context of overall global weakness, and the potential for the US data to weaken once again as well.

That may be what is indeed expressed in the FOMC meeting minutes. It has a well-known penchant for respecting both the US data and the global situation since it backed off from the more aggressive view expressed in its first hike meeting back in December. That was reversed in the lowered future rate hike projections for 2016 at its March 16th meeting.

And this would seem wise, even with the recent bout of stronger data. This is because the broader ‘macro’ outlook remains weak for the developed economies. Consider the OECD Composite Leading Indicators (CLI) that were released last Wednesday morning. The less than optimistic outlook for much of the developed world continues to reinforce our bearish instincts, as you can see in our mildly marked-up version. Especially the weakness of the US, UK and Germany, with stallouts now seeming to start in some of the previously more upbeat European economies, remains negative.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) discussion of some of the factors noted above as well as key specifics of the US economic data that improved. There has also been quite a bit of weak economic data elsewhere, yet that has recently been buffered by surprisingly (even suspiciously) strong Japanese GDP and also strength in UK Employment figures. There is also the ECB meeting ‘account’ release on Thursday.

It moves on to S&P 500 FUTURE short-term at 04:00 and intermediate term view at 06:00, with OTHER equities from 08:30, GOVVIES beginning at 13:15 (with the BUND FUTURE at 16:15 including implications of the early March expiration rollover) and SHORT MONEY FORWARDS from 18:30. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 21:15 EUROPE at 23:00 and ASIA at 26:00, followed by the CROSS RATES at 28:30 and a return to S&P 500 FUTURE short term view at 31:30. We suggest using the timeline cursor to access the analysis that is most relevant for you.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Read more...