2016/06/24 Commentary: Beyond Brexit

© 2016 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY (Non-Video): Friday, June 24, 2016

Beyond Brexit

This is why we took this week off for a holiday. As noted early in last Friday’s TrendView video analysis and outlook, “…unstable activity into that major binary REMAIN or LEAVE decision in the UK. Recent market activity has highlighted how the UK decision is also a decision for Europe as well. And of course, this extends to the rest of the global economy to a lesser degree on the outlook for overall economic growth and especially merchandise trade.” Further, “…increasingly unpredictable activity into the binary REMAIN or LEAVE decision in the UK referendum on EU membership next Thursday means markets are now not macro-technical with an Evolutionary Trend View (ETV) into all of next week.”

This is why we took this week off for a holiday. As noted early in last Friday’s TrendView video analysis and outlook, “…unstable activity into that major binary REMAIN or LEAVE decision in the UK. Recent market activity has highlighted how the UK decision is also a decision for Europe as well. And of course, this extends to the rest of the global economy to a lesser degree on the outlook for overall economic growth and especially merchandise trade.” Further, “…increasingly unpredictable activity into the binary REMAIN or LEAVE decision in the UK referendum on EU membership next Thursday means markets are now not macro-technical with an Evolutionary Trend View (ETV) into all of next week.”

Rather than “we told you so”, this is more so a reminder of something we suggest from time to time for lesser analysis challenges: When markets are inherently un-analyzable, stop trying to analyze them. Better to forego some near-term profit, and only re-engage once the situation clarifies. Even the Chinese currency disruption back in August and the early year economic weakness driving market psychology were relatively analyzable.

However, the close call on such a major decision in the UK on Thursday was a completely different radical ‘binary’ outcome. The markets confidence in the REMAIN camp prevailing was obvious. Yet that also raised the risks if the LEAVE camp succeeded in removing the UK from the European Union. That REMAIN campaign confidence left the markets closing on Wednesday and trading Thursday at the levels consistent with that outcome rather than at more circumspect levels. As such, the equities were very well bid, the British pound and all other currencies (including the emerging market currencies) were strengthening against the US dollar, and the sovereign debt markets had spent the previous several sessions giving up their ‘haven’ bid in the face of the likelihood of the ‘normal’ extension of the global economic situation.

Of course, to state what is already glaringly apparent, at the moment the success of the LEAVE campaign became apparent all of that was massively reversed. Yet with due respect for the initial sharp swing in thin overnight markets, even within that the levels at which markets have stabilized are not so radical at all. There are quite a few quick observations below in all asset classes on how all of this is progressing in a much more orderly fashion than some of the Cassandras suggested it might.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

Read more...

2016/06/17 TrendView VIDEO: Global View (early)

2016/06/17 TrendView VIDEO: Global View (early)

© 2016 ROHR International, Inc. All International rights reserved.

The analysis videos are reserved for Gold and Platinum Subscribers

TrendView VIDEO ANALYSIS & OUTLOOK: Friday, June 17, 2016 (early)

[GENERAL UPDATE Market Observations updated after Friday’s US Close]

First of all, our sympathy goes out to family and friends of UK Labour MP Jo Cox. Kudos to the UK’s political leaders for recalling Parliament to mourn her loss. It seems that her attacker was motivated by strong LEAVE sentiment in the UK European Union membership referendum next Thursday. Whether or not that is so, it has garnered sympathy for the REMAIN campaign in the near term, which makes the outcome of the referendum more so in doubt than recent polls showing a slight lead for the LEAVE campaign. While it is hard to know just what events in the non-financial world have an impact on the markets (or what degree), there is a sense that this likely equalization of the referendum’s outcome was at least partially responsible for Thursday afternoon’s sharp reversal of negative sentiment. While it seems a shame to base a market psychology on such a tragic event, the coincidence is hard to ignore.

Yet this also points up another aspect of markets into next week that will be impossible to ignore: increasingly unstable activity into that major binary REMAIN or LEAVE decision in the UK. Recent market activity has highlighted how the UK decision is also a decision for Europe as well. And of course, this extends to the rest of the global economy to a lesser degree on the outlook for overall economic growth and especially merchandise trade. As noted extensively of late, the OECD and other NGOs have warned that the already low and weakening levels of international trade have classically been indicative of future major weakness in the global economy. While any UK exit from the EU would hamper their trading relationship, the UK revising its trade agreements with the rest of the world would affect everyone. IMF Managing Director Lagarde just said so in so many words.

_____________________________________________________________

Video Timeline: It begins with macro (i.e. fundamental influences) discussion the factors noted above as well as the mixed nature of all of the recent data. It also mentions the additional influence of accommodative central banks into Thursday morning that did not help the psychology, yet with some reasonably strong data now also more apparent.

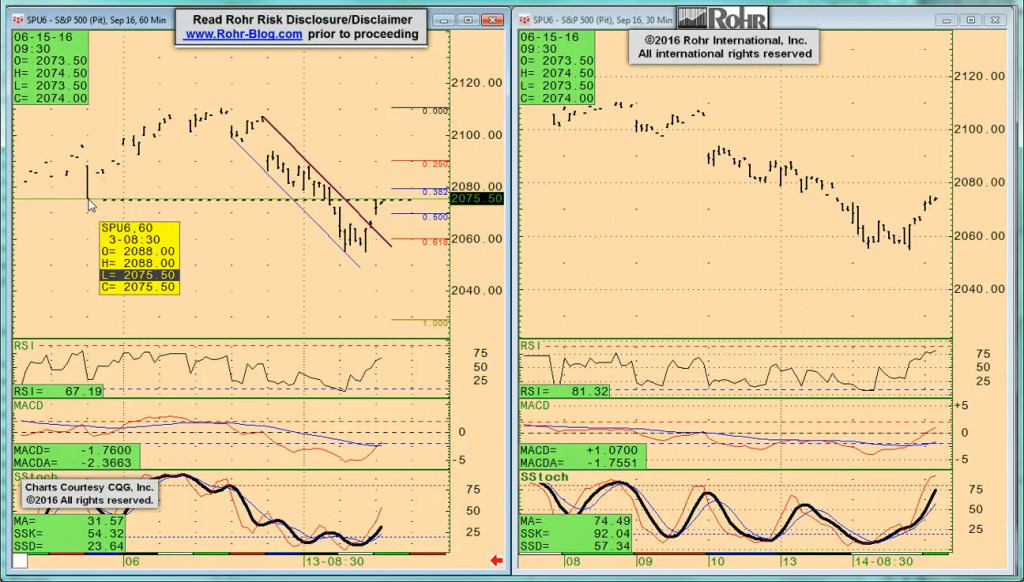

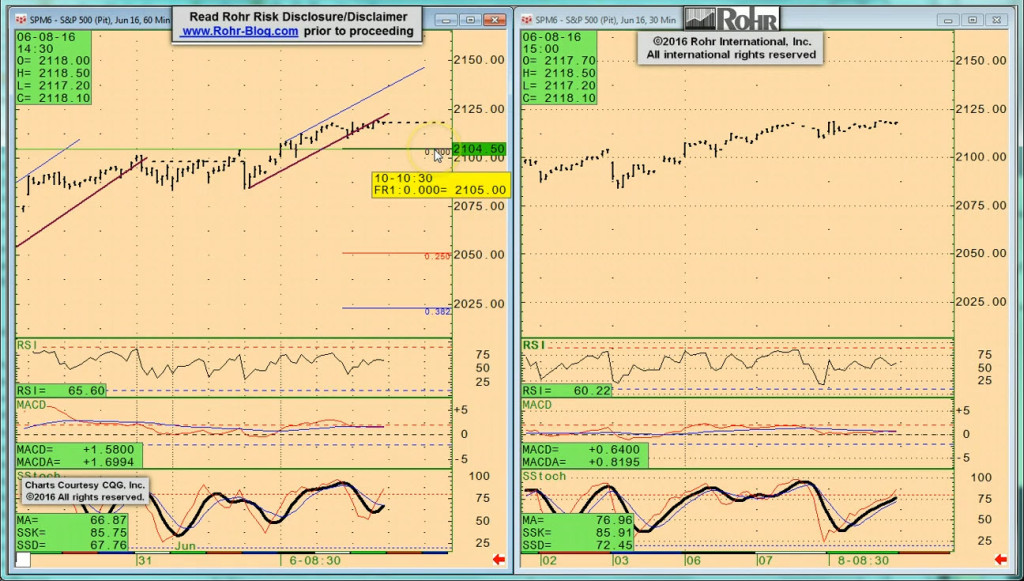

It moves on to S&P 500 FUTURE ‘Quick Take’ up to 03:45 followed by the short-term view at 06:15 into the intermediate term view at 07:30, with OTHER equities from 10:00, GOVVIES beginning at 12:15 (with the BUND at 15:45 including implications of expiration rollovers) and SHORT MONEY FORWARDS from 17:15. FOREIGN EXCHANGE covers the US DOLLAR INDEX at 19:30 EUROPE at 21:30 and ASIA at 25:45, followed by the CROSS RATES at 28:30 and a return to S&P 500 FUTURE short term view at 32:30. As this is a longer than usual discussion, we strongly suggest using the timeline cursor.

_____________________________________________________________

Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion and TrendView Video Analysis and General Update. Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Read more...