2016/07/28 Commentary: Typical-Perverse FOMC Reaction

© 2016 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY (Non-Video): Thursday, July 28, 2016 (late)

Typical-Perverse FOMC Reaction

As we have noted on quite a few occasions, and mentioned again in the Market Observations appended to Wednesday morning’s Commentary: No Fear of Fed, there was “…very typical ‘rebellion’ again against the Fed’s return to a more upbeat psychology.” While the various asset classes may get into step with the Fed’s more constructive view of the US economy at some point, the reaction so far points up the risks in taking any signs from the near term releases as a sustained economic shift. In fact, the Fed’s timing in that regard seems to be consistently off target.

As we have noted on quite a few occasions, and mentioned again in the Market Observations appended to Wednesday morning’s Commentary: No Fear of Fed, there was “…very typical ‘rebellion’ again against the Fed’s return to a more upbeat psychology.” While the various asset classes may get into step with the Fed’s more constructive view of the US economy at some point, the reaction so far points up the risks in taking any signs from the near term releases as a sustained economic shift. In fact, the Fed’s timing in that regard seems to be consistently off target.

It’s ‘normalcy bias’ is showing once again. It is either too anxious to be hawkish in spite of near-term factors which do not justify that more hawkish view (September 2015 for one example), or it is easily swayed by firmer data (December and of late) that gives way to weaker indications which leave its more hawkish view seemingly out of step once again.

That overall context makes it much easier to understand the various asset classes’ reactions to Wednesday’s more constructive FOMC Statement. Let’s allow that any shift into more hawkish Fed perspective can be problematic for equities. They then tend to question whether “good news is ‘good’ news”, or possibly ‘bad’ in fomenting any actual tightening from the Fed. And it is especially challenging for equites when the economic data reverts to weakness, as it has at present (more below.)

However, there was every reason to believe the more hawkish tone should have been good for an already buoyant US Dollar Index. Except that it wasn’t. Another victim of the real world economic indications weakening once again? Very possibly. Right in line with that was yet another very typical-perverse market refutation of the Fed’s more hawkish perspective: fixed income markets rallied. Govvies which had already rebounded from slightly below key support advanced further in the wake of the Statement release.

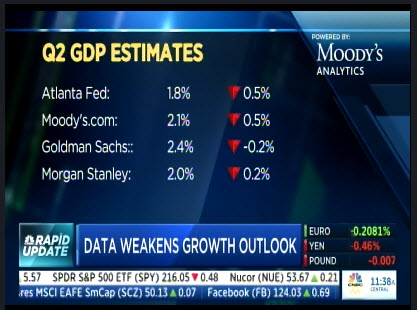

It is also of note that none of the Federal Funds futures out through the end of 2016 indicate anywhere near a 50% chance of an FOMC hike by the end of this year (see CNBC clip below.) Obviously much as with the Fed itself, the markets are ‘data dependent’, and any sustained improvement will bring greater US dollar strength and govvies weakness. Yet on current form if any of the anticipated UK Brexit weakness develops along the lines that the forecasters suspect, a Fed hike this year remains problematic. We shall see.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

2016/07/27 Commentary: No Fear of Fed

2016/07/27 Commentary: No Fear of Fed

© 2016 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

COMMENTARY (Non-Video): Wednesday, July 27, 2016

No Fear of Fed

That negative potential relates to any sense the next rate hike might actually be closer at hand than previously expected. Hawkish language might even encourage some analysts to speculate that the September 21st full forecast and press conference rate decision is ‘live’, even though most do not expect anything in the more fraught global environment (Brexit and Japan) until December. We agree with the latter camp, as the circumspection exercised by the BoE and ECB is likely temporary. As the next ECB meeting is not until September 8th, the BoE full Inflation Report revised projections and press conference meeting on August 4th was always going to be the more critical horizon.

Of course, that is also because the more pronounced deterioration of business sentiment has been in the UK. It even prompted the previously circumspect outgoing BoE Monetary Policy Committee member Martin Weale to suggest the BoE should now move more aggressively in its response to the looming Brexit economic headwinds. What does all this have to do with the FOMC today or rate decision on September 21st? Quite simply, if the rest of the world is easing due to clearly weaker tendencies, it makes it that much harder for the FOMC to put through a hike that might weigh on the US economy that the rest of the world is still counting on to lead the way higher.

There is also the risk that greater accommodation elsewhere will already be weakening those countries’ currencies. Any Fed hike would only exacerbate that, with potential risks to US exporters and multinational companies’ earnings. That may still not stop the FOMC from hiking in September. Yet it will likely set a backdrop to more hawkish Statement language today which still leaves the equities holding on any near term setback. It will still be a bit of a ‘Goldilocks’ psychology on international factors restraining the Fed.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

Read more...