2020/04/13 Commentary: Testing Trauma

© 2020 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Platinum Subscribers

COMMENTARY: Monday, April 13, 2020

There’s an awful lot being tested in medical, financial and psychological realms. Another of our old market axioms is, “You can't trade the market you ‘want’; you can only trade the market you ‘have’.” The sudden change into conditions which are not consistent with many folks' experience is causing stress for medical professionals, the public, politicians and market participants.

As noted in Thursday’s ‘Colossal Cross Currents Indeed’ research note, the massive government response still flies in the face of less effective actions that may mute its impact. And that is regardless of the recent addition of further massive Fed actions (FOMC multifaceted program link https://bit.ly/2JTGfra) that are going to leverage all of the major US Treasury funding for rescue programs.

The good news is US EQUITIES are maintaining their ‘triumph of hope over reason’ bid, likely due to further upbeat assertions of US politicians that the recent erratic start to the COVID-19 rescue programs will be addressed soon. Yet despite this Brobdingnagian financial support, the flow of the funds has been obviously less than effective.

Among others in the political class and business folks, successful entrepreneur and sports franchise owner Mark Cuban laid out fine line developments in a CNBC interview (https://cnb.cx/2K0auNj) on how problems are defusing the potentially positive impact of the major Paycheck Protection Program (PPP.)

In some ways the traumas are interrelated under the massive impact of COVID-19. Among the other aspects of the ‘testing’ nature of the situation, one of the most obvious and telling is at the politico-economic nexus. It is a lot of trauma for President Trump. Despite his trumpeting (pardon the pun) his effective shutdown of Chinese-US travel in late January, he continues to deflect on his less effective steps in weak US response to the (at some point obvious) threat from COVID-19.

The three most obvious forms of late are his claims the US has ‘great testing’ (which seems in part an attempt to deflect criticism for actually being behind the curve on this necessary component of safely reopening the US economy), that he took effective action at all points, and that as President he has “absolute power” (that is a direct quote) to direct the states to reopen their economies even though he never instituted a national social distancing and economic shutdown policy.

Constitutional Short-Course

On the latter, it is a bit scary watching Donald Trump repeatedly claim in a live press conference that as President he has “absolute power”; it goes to a fear that he is as extreme a megalomaniac as had been feared based on previous words and attempted actions. It also speaks of the man at the top having a distinct lack of understanding of the US constitution and federalist system. It seems the President would prefer to be running the government he’d ‘want’ rather than the one he ‘has’... and this is not the first time he has acted in this manner.

And he shut down the repeated questions on this by accusing the inquisitors of being ‘bad reporters’ asking ‘unnecessarily negative questions’. Yet the expert opinion is clearly not on his side. As a Reuters article (https://reut.rs/3cjwe2C) that was updated Tuesday morning notes, “...a US president has quite limited power to order citizens back to their places of employment, (and other measures.)” In fact, respected NY Governor Cuomo has said he would ignore such an order if it was inconsistent with the best interests of the health and welfare of his constituents.

Typically Misdirected Government 'Rescue'

And the government response so typically has the cart out in front of the horse, even if a necessary psychological step at this point. This was clearly laid out in a March 25th City Journal interview (https://bit.ly/3a33cD2) of the estimable Paul Romer, the crux of which he has repeated in recent live interviews. In the first couple of paragraphs he explains the current disconnect between what is actually needed and the US (along with other governments’) response: supporting the incomes of workers without providing them any incentive to feel safe.

That is the only thing which will encourage them to go out and actively engage in the economy. As we (among many other, more highly qualified folks) have noted, he posited, “We need widespread, regular testing to figure out who should be in quarantine and who should be allowed, at least provisionally, to get back to their regular lives: back to work, back to producing, earning income, and spending.”

Testing Key to Limiting Reinfection

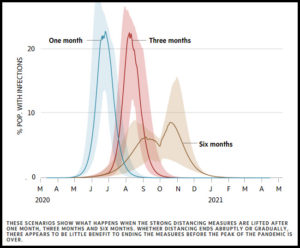

Highlighting an informed opinion on this, we return to the previously referenced article in Toronto’s Globe and Mail (https://tgam.ca/3dwzBoi) on when and how social distancing can end (or at least be reduced.) Especially note the graphs a bit lower down on ‘flattening the curve’ of the infection spread, and even more so the one below on what is necessary to fully suppress the pandemic’s impact. Admittedly the latter does not include any assumption of rapid response testing, and the chances are this would mitigate obvious worst-case scenarios.

Yet the Trump administration remains unprepared despite the President’s claim that, “(paraphrased) we have the tests and ours are the best.” This is just untrue, especially in the context of ‘rapid response’ tests, which the US lacks. The reality is also that they would need to necessarily be repeated on a regular basis to monitor and implement selective quarantines, instead of the current destructive general quarantine. Romer covers it all in the interview.

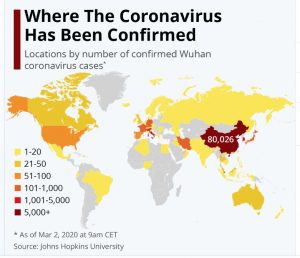

While CNN’s Jim Acosta is not our favorite reporter, Trump and Pence responses to his questions at a recent press conference (https://cnn.it/34Bv8No) highlights the disconnect. [Trump for the first 45 seconds, and be sure to catch the CNN fact checker’s brief discussion from 03:25 through the end of the clip.] The ironic bit right now is the place on earth where it is easiest to get tested and be provided a rapid response: Wuhan. That’s right, possibly due to the major origination there.

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.